Industry Insights May 2022

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business.

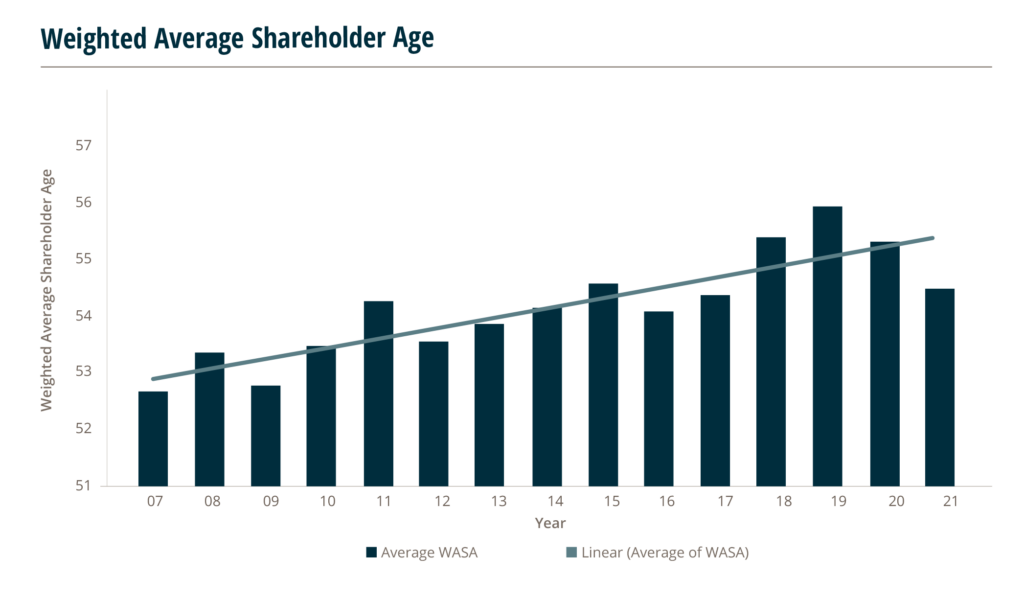

Weighted Average Shareholder Age (WASA) Is Decreasing for Insurance Brokerages

Average owner age of private insurance brokerage firms has fallen noticeably in the past couple of years according to PHP. This ratio shows the average of the shareholders’ age weighted by the percentage of stock they own. For an individual firm, a high result may indicate the need to transition stock or perpetuate ownership.

In 2019, average WASA was approaching 56. However, it dropped in the following two years, registering below 55 in 2021. Historically, recessions have prompted workers to retire, so the drop in 2020 and 2021 may be a result of older agency owners deciding to retire. Rising valuations in recent years may have also encouraged older owners to separate with all or of part of their holdings.

Firms that have a higher WASA vs. average firms should consider investing time and effort into equity succession planning. Broad ownership can motivate stakeholders to drive new business production and organic growth. A clear perpetuation strategy for key staff can also help create a strong feeling of purpose and motivation for the team. When leaders have a vested interest in the success and future of the firm, this can help drive performance and focus.

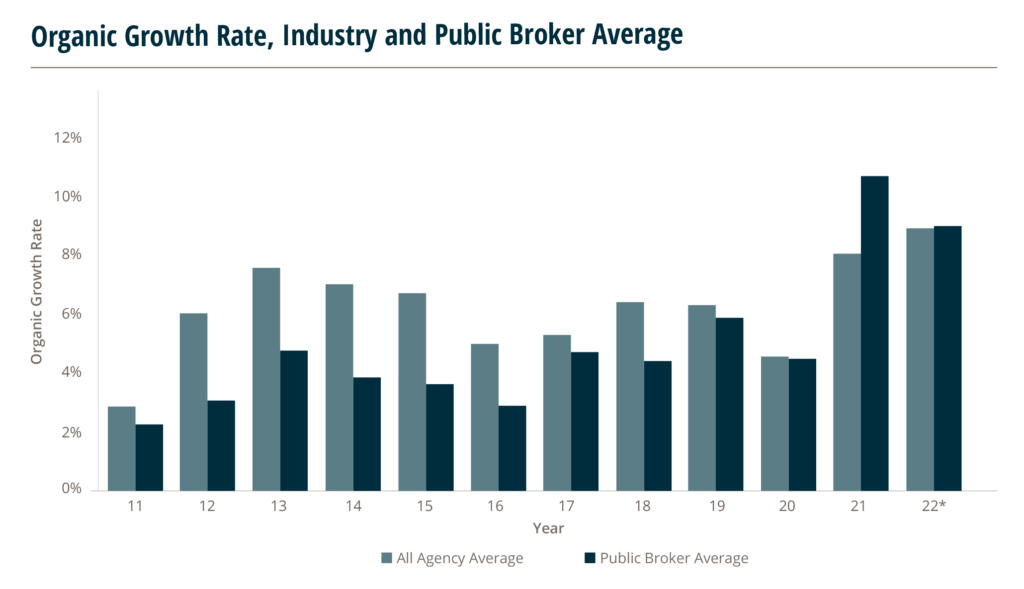

Public Brokers Continue to Have Strong Growth Outlook

Historically, the industry organic growth rate average, as measured by PHP, has tended to outpace the public broker average — although public brokers have closed in on the gap over the past two years and significantly surpassed the industry average in 2021.

2021 marks the first time that the public broker average has surpassed double digits over the past decade. Since its IPO in 2019, the addition of BRP Group, Inc. (BRP) has been a boost to the overall public broker index. BRP aims to become one of the ten largest insurance brokers nationwide within ten years and grew at 18% in 2021. However, 2021 was also a strong year for the rest of the public broker cohort, with Arthur J. Gallagher & Co. (AJG), Brown & Brown, Inc. (BRP), and Marsh & McLennan Companies, Inc. (MMC) all experiencing double–digit growth, compared to growth in the low single digits over the past five years. Looking ahead to 2022, the public brokers continue to have a favorable growth outlook, buoyed by a rebound in economic activity (and rising exposure units), continuing hardening rates, and inflation.

Global 3/31/22.

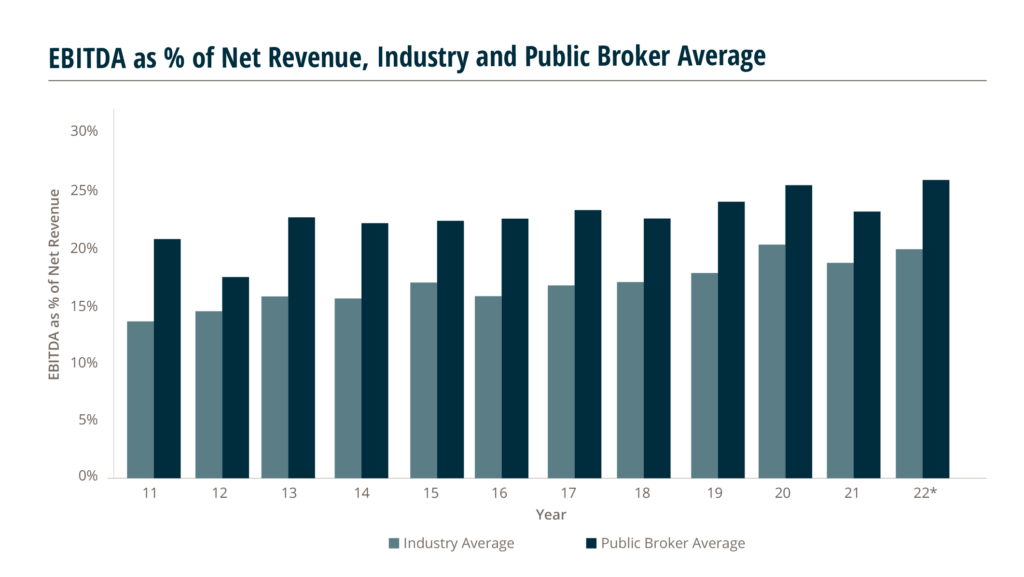

Industry and Public Broker Average EBITDA

When it comes to profitability, the public broker average tends to outperform the industry average by approximately 5–6 percentage points per year. 2020 was a banner year for profitability amongst public and privately held brokers alike, and in 2021 many continued to hold onto margin improvements despite resuming increased investments and routine business expenses.

Looking ahead to 2022, public brokers have a positive outlook on profitability, and despite increased growth investments, they expect to be able to keep margins flat with 2021 or even show margin expansion. Douglas Howell, AJG’s CFO commented during the 1Q2022 earnings call that margin expansion in 1Q2022 was impacted and may continue to be in 2022 by a “return of expenses as we come out of the pandemic,” which may include travel, entertainment, and other office costs. Howell noted that AJG plans investments for long–term growth in the areas of marketing, advertising, consulting, professional fees, and IT, but AJG should be able to absorb those costs and potentially show margin expansion depending on organic growth for the year.

Broker Data: S&P Global 3/31/22. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization.

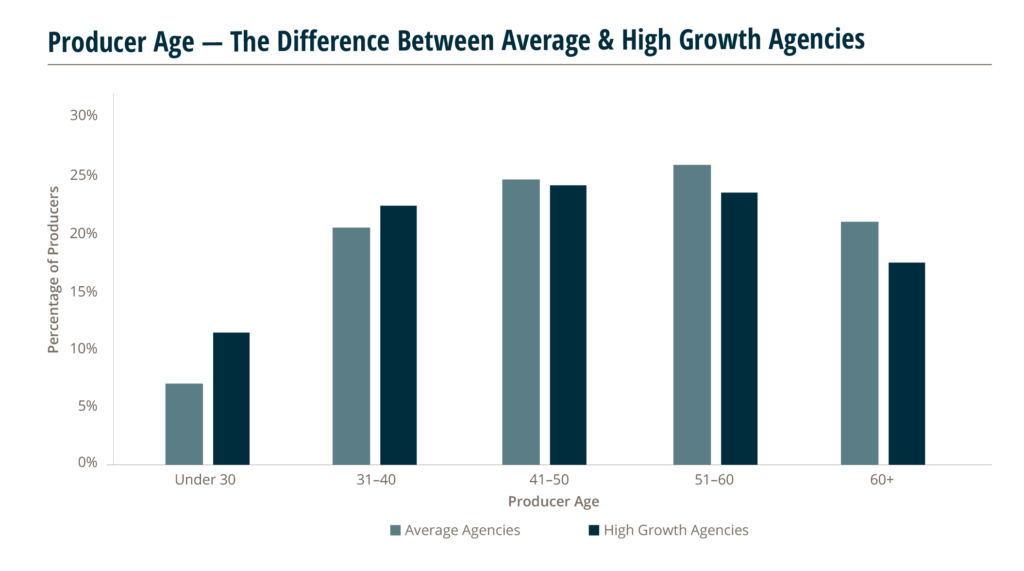

High-Growth Firms Tend to Have Younger Producers

Are high–growth insurance agents and brokers more proactive in recruiting younger talent? MarshBerry reviewed insights from PHP to see what the average age distribution is among production staff in high–growth firms compared to the average ones in the database.

In high growth firms, 35% of producers are under the age of 40, compared to only 28% in average firms. The largest variance is in the under 30 age bracket: which comprises 12% of total producers in high growth firms, compared to only 7% for the average. In high growth firms, only 42% of producers are over 50, while this number jumps to 47% for average firms. We can see there is a tendency for high growth firms to hire younger talent, whereas average firms are falling behind in this regard.

Many agencies and brokers may not be doing enough today to position themselves for success in the future. It is imperative to continually hire young producers to foster growth, transfer knowledge from more experienced producers, and help develop the next generation to perpetuate the company. Investing in coaching, training, and development is critical for their — and the company’s — long–term success.

4/18/2022. “High Growth Agencies” are those that rank within the top 25% based on organic growth.

This article has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.