Industry Insights July 2022

MarshBerry’s Perspectives for High Performance (PHP).

Insights from our proprietary financial database to help drive your business.

What’s your NUPP? Are You Investing Enough in New Producers?

The Net Unvalidated Producer Payroll (NUPP) metric measures a firm’s investment in unvalidated producers. NUPP is calculated by first identifying the total payroll expense of all unvalidated producers in a firm. Then, you calculate how much they would earn, based on their book of business, under a standard blended commission rate (27.5%), which is the “validated” or “earned” compensation. Subtract the validated compensation amount from the actual compensation amount and the difference is divided by net revenue to yield the NUPP metric for the firm.

According to PHP, the Best 25% of MarshBerry’s Connect executive peer exchange firms invest more in unvalidated producers compared to the Connect average. This indicates that the top performing firms may put greater effort and investment into developing the next generation of producers.

Additionally, high growth firms tend to hire more employees who are newer to the industry (interns, recent college grads, quality people from service industries) which not only fosters growth, but also creates coaching and mentoring opportunities and ultimately a pipeline of perpetuation candidates.

How Firms can Proactively Manage Leakage

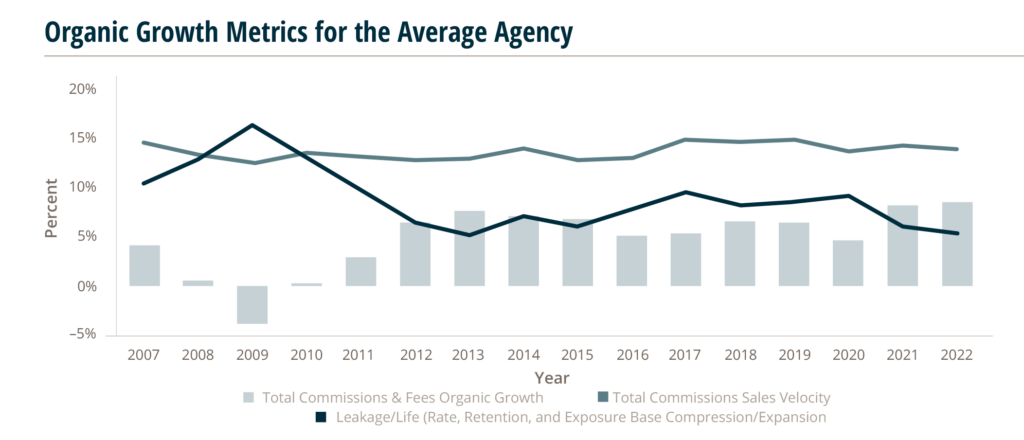

When it comes to key performance indicators, leakage is important, but sometimes overlooked. Firms can find ways to manage leakage, which is the difference between a firm’s organic growth rate and new business rate. For example, if a firm wrote 14% in sales velocity (new business as a percentage of prior year commissions and fees) and had an organic growth rate of 8%, its leakage rate would be 6%. There is a direct relationship between the three variables.

The insurance industry has seen historically low leakage rates over the last 18 months. There was a large dip in leakage from 9.1% in 2020 to 6% in 2021, which resulted in a then–peak organic growth rate of 8.1% for the average agency. MarshBerry’s preliminary data for Q1 2022 shows leakage dipped even further to 5.5% — near the lowest (which was seen in 2013) in our PHP database that dates back to 2007. Sales velocity has maintained consistently around 14%, thus resulting in a peak organic growth rate of 8.4%.

Whether the low leakage rates continue or reverse, there are a number of ways to combat leakage. The easiest method is to simply write more new business, which seems like a basic solution, but as most of you reading this article know, is not easily done. Getting in front of “bad renewals” by educating your clients about what’s to come and what’s happening in the market will help them be prepared for a potential premium increase. Implement a process where your team remarkets accounts if the increase reaches a certain threshold to ensure you can tell clients, with confidence, that the deal you’re presenting is the best deal for them. Don’t get hypnotized by increased rate as growth, that’s a trap.

When prospecting, have producers talk about the marketplace. Ask prospects how their current relationship is helping them prepare for a potential increase. Arm your producers with data that your competitors aren’t talking about. Become an expert in their industry so they know the impact that the state of the market could potentially have on your prospect’s business. Try to engage with carriers more often so you have up to date information, and to gain insight on when the market may soften.