Industry Insights August 2022

MarshBerry’s Perspectives for High Performance (PHP)

Insights from our proprietary financial database to help drive your business.

Growth Rates in Business Insurance Top 100 Brokers

As insurance firms continue to consolidate and “barriers to entry” increase, organic growth could be key in identifying valuable firms.

While the “barrier to entry” hasn’t risen significantly — a broker needed $19.3M to enter into Business Insurance’s Top 100 nearly twenty years ago, compared to $24.4M in 2022 — it has become more difficult to break into the top 50.

$24.4M

Needed by a Broker to Enter into

Top 100 in 2022

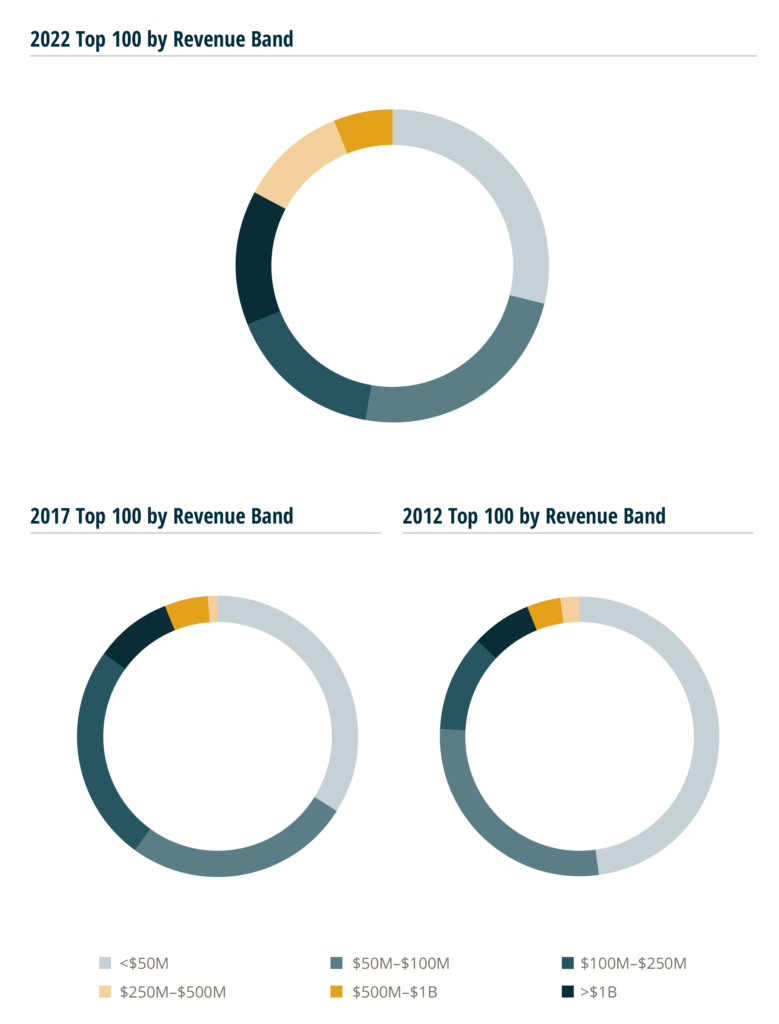

The 50th ranked broker on the list has grown 149% in revenue since 2002, while the 25th rank has grown 318%, and the 10th a staggering 735%.

Growth has been driven by a combination of acquisitions and presumably organic growth. In 2021, the top 10 brokers’ revenue comprised 66% of the total Top 100 revenue. This ratio has trended down over the years, driven by revenue growth within the 11th – 50th ranked brokers.

2021

Top 10 Brokers’ Revenue Comprised 66%

of the Total Top 100

While the overall YoY revenue growth of the combined Top 100 firms was 19.1%, 42 of those firms individually failed to grow by 10% or more. And given the hard Property & Casualty (P&C) rate environment (where increased premiums should be naturally bolstering revenue), it can be assumed that nearly a quarter (24 firms) of the Top 100 firms’ “growth” is either negligible or negative since they failed to exceed 6% growth YoY.

This includes all growth, organic and from M&A — which comes at a much higher cost. Organic growth is key to the future outlook of a firm and more highly valuable to carrier partners.

Within Connect, MarshBerry’s executive peer exchange network, the average organic growth rate all of firms in 2021 was 8.4%. According to PHP, MarshBerry’s proprietary financial database, the Best 25% of firms within the network had an 18.3% organic growth rate in 2021. This exceeded 66 of the Top 100 insurance brokers’ growth rate.

18.3%

was the Organic Growth Rate in 2021 of

the Best 25% Firms in PHP

In the latest data, firms are seeing a lift from overall good economic conditions. Favorable conditions such as rising interest rates have increased investment worth as firms grew over the past year.

If these conditions worsen, with fears of an upcoming recession and stock market volatility, firms will be forced to be more proactive regarding growth.

Source: S&P Global Market Intelligence, Insurance Journal, and other publicly available sources. 7/8/22.

Surplus Lines Premiums Surge in the First Half of 2022; Strength Seen Continuing in Second Half

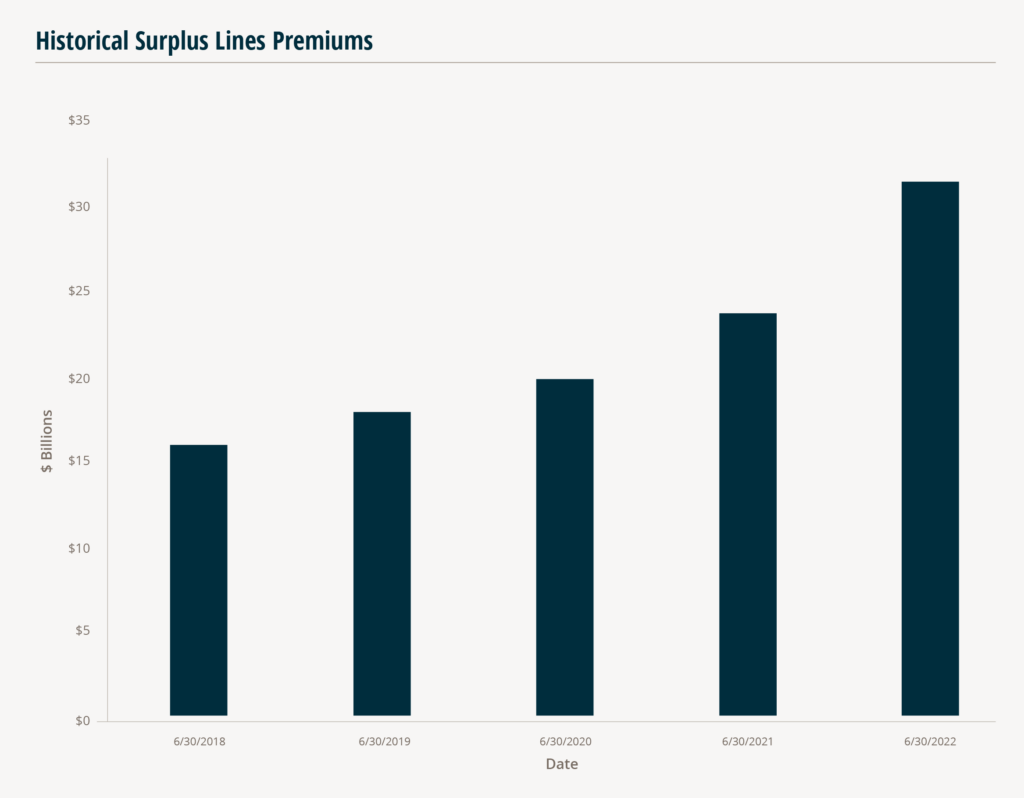

Surplus lines premiums rose 32.4% to $31.4 billion in the first half (H1) of 2022, according to the U.S. Surplus Lines Service and Stamping Offices’ 2022 mid–year report. This compares to the same period a year ago (H1 2021) where surplus lines premiums rose 21.9% for a total of $24.04 billion. This continues the growing trend of surplus lines premium growth over the last several years. The H1 of 2019 saw a growth rate of 12.6% YoY, while H1 2020 increased by 10% YoY.

There will likely be continued strength in the surplus lines market in the second half of 2022 as stamping offices usually report higher premiums in the third and fourth quarters compared to the first and second quarters.

WSIA also stated that “most predict dynamic economic factors will drive continued growth for the surplus lines market for the balance of 2022.”

Growth Rate of Surplus Lines Premiums

H1 2022

32.4%

H1 2021

21.9%

H1 2020

10%

H1 2019

12.6%