U.S. Macroeconomic Indicators Vol III, Issue 4

Fed Cuts Rates 50 Bp: Potential Impact To M&A Activity

The Federal Reserve (Fed) cut interest rates by 50 basis points at its September meeting, bringing the benchmark federal funds rate to a target range of 4.75% to 5%. Fed Chair Jerome Powell said officials have gained greater confidence that inflation is moving towards its 2% target and are now becoming attentive to both sides of the dual mandate (price stability and maximum employment). This should create a recalibration of the policy stance to a more neutral level.

The Fed’s interest rate cut of 50 basis points instead of 25 basis points indicates that the Fed is focusing on avoiding a recession in its first rate cut since 2020. Powell reiterated the Fed is “not on a preset course” when it comes to rate cuts going forward and will continue making decisions meeting by meeting.

Fed officials also updated their projections for appropriate monetary policy going forward. Officials foresee a faster path to rate cuts than they did back in June. Their median prediction for the fed funds rate in 2024 is 4.4%, implying an additional 50 basis points of rate cuts for the remainder of the year. There are two more meetings in 2024, in November and December. The median fed funds projection for 2025 is 3.4%, down from 4.1% in June. Officials expect interest rates to settle around 2.9% in 2026.

Rate Cuts Could Drive Greater M&A Activity

The start of rate cuts may lead to an uptick in debt capital borrowing for everything from auto loans, home mortgages, and debt borrowing to fuel merger and acquisition (M&A) opportunities. As interest rates decrease and the cost of debt goes down, acquisitions tend to become less expensive, with a positive impact on the return on investment (ROI) for buyers. For private equity (PE) firms, reductions in interest rates may also impact the IRR (internal rate of return) on investments creating more flexibility to take on debt for acquisitions.

How Insurance Brokerage Firms May Be Impacted By The Fed Rate Cut

Despite the elevated cost of capital, there was still significant buyer capacity and demand for insurance brokerage M&A in the first half of 2024. Now with the recent Fed interest rate cut (and projections for more), combined with the possibility that some taxes may increase in 2025 depending on the outcome of the presidential election – we may see a strong end to 2024 for M&A deals.

Brokers who may be looking towards a partnership or outright sale in 2024 or beyond should consider these strategies to best position themselves in this improving interest rate environment:

- A greater focus on organic growth. As inflation continues to stabilize, firms may not be able to count on the hard market rates to help drive revenue and growth. Savvy buyers are increasingly looking at firms’ quality of growth (QoG). These metrics include sales velocity and strength of a firm’s organic growth, without the influence of rate-driven revenue.

- Consider strategic investments in technology. Today, buyers are also looking at the data and technology capabilities of target firms. They want to understand the platforms being used to manage people, activity, pipeline, projections and any points of differentiation that make them stand out. As borrowing costs decrease, insurance brokerage companies should consider investing in insurance technology to improve processes and data capabilities, helping boost their competitive edge.

The Differences Between A Soft And Softening Market

In the insurance industry, most market environments are labeled hard or soft. The current cycle, which technically started in 2019, but accelerated right after COVID in 2021, is one of the longest hard markets since the 2001-2004 hard market. Insurance premiums across most lines have been steadily increasing for roughly the past five years.

Recently, there has been a slowdown in premium increases and lower profit margins. Does this mean the hard market is coming to an end? While the answer varies depending on things like business line and location, we are certainly entering a softening market.

Characteristics Of Insurance Market Cycles

The cyclical nature of the insurance market means the market will swing from soft market to hard market and back again. It is continuously changing, adapting to current economic conditions and loss projections. MarshBerry defines a hard market as a period where product premium rates increase by over 5% for two or more years. On average, a hard market is defined as a period of increased premium rates, restricted coverage, and lower capacity – caused by an increase in demand and decrease in supply of policies.

A Soft Market Is Not The Same As A Softening Market

“Soft market” and “softening market” both refer to different stages of the insurance cycle but are not the same thing. This is especially notable because the change from hard market to soft market is gradual, can take years, and may not always cycle in one direction.

A soft market is characterized as a time period when insurance premium rate changes are low (below the +5% rate increase threshold) or decreasing, and coverage is widely available.

A softening insurance market can actually still be a hard market. Case-in-point, after commercial rates hit the cycle high of 11.7% in Q3 2020, there was a softening of commercial rates in Q4 2020 (+10.7%), Q1 2021 (+10%), Q2 2021 (+8.3%), to a low in Q1 2022 (+6.6%). Since then – rate increase percentages ticked higher, reaching +8.9% in Q2 2023.1 But this is all still well above the consistent +5% increase for two or more years – qualifying current conditions as a “hard market.”

A softening insurance market can be characterized by:

- Stable or declining premium rate changes.

- Insurers offering broader coverage options and additional policy features.

- Increased capacity of insurers willing to underwrite policies.

- An increase in the maximum amount a policy will pay (liability limit).

- Easier access to excess coverage beyond the primary policy.

- Increased competition among insurance companies for new business.

History has shown that terms like soft market and hard market are flexible and that all insurance lines don’t experience cycles at the same time. Think of a softening market as transitionary – insurance conditions are beginning to ease, but the market hasn’t fully reached the soft stage yet.

Signs Of Softening

P&C insurance is predicted to remain in a hard cycle through the rest of 2024 but may soften in the new year.

Unlike previous fully soft markets, experts don’t foresee a sharp decline, but more of a moderation. For example, in both the late 1970s and mid-1980s, profits (net written premium) plunged by almost 15% in just two years.2 The current cycle is unlikely to see profits drop this quickly.

Other evidence of softening is the recent premium decreases in workers compensation, cyber, directors and officers (D&O) and employment practices liability insurance (EPLI). Cyber’s 1.7% reduction in premiums was particularly significant compared to past years’ increases of 20% or higher.3 This is most likely due to increased competition in cyber insurance, which drives premiums down, in addition to frequent cyberattacks and claims payouts. Commercial property & casualty (P&C) premiums only increased 5.2% in Q2, perhaps getting closer to that +5% threshold and another sign of a softening market.

Benefits Of A Softening Market For Brokers

Brokers should try to get ahead of the transition so that they can take advantage of the benefits of a potential softer market. Now is the time to get staff ready to sell more and perhaps increase marketing spend. One major win is that rate increases are slowing down, which is good for clients, but doesn’t drastically reduce commissions, which is also good for brokers. Other specific ways a softening market can be advantageous include:

- Increased competition: With multiple insurers vying for the same pool of customers, competition intensifies. Insurance carriers may employ various strategies to stand out, such as offering discounts, enhanced customer service, or innovative policy features.

- Flexible terms: Insurers might be more open to negotiating terms and conditions, customizing policies to meet the specific needs of clients, which will help brokers attract more prospects.

- More affordable premiums: As the market begins to soften, and insurance premiums begin to decrease (or not increase as quickly) insurers will strive to undercut their competitors with better rates to attract new business. This can result in more affordable insurance coverage for policyholders and is a good time to focus on growing the customer base and not just premium.

- Relaxed requirements: During a hard market, insurance carriers are more cautious but as the market softens, carriers become less selective in the risks they are willing to insure, leading to less restrictive terms and conditions.

Insurance companies typically become more accommodating in softer markets to attract customers, which brokers can leverage to negotiate better rates. Those firms without the proper tools, technology, and processes to reinforce their sales culture will see their customers start to shop around.

This transitional period is a key time for insurance brokers as the effects may be felt in their business and with consumers. Clients may ask to shop around for better rates or producers may worry that they need to take drastic action to maintain profitability. While a softening market doesn’t signal a need to completely change strategy, brokers should start to prepare for slight adjustments in business goals or marketing methods.

Longest Inversion Of U.S. Yield Curve Finally Ends – But What Does It Mean?

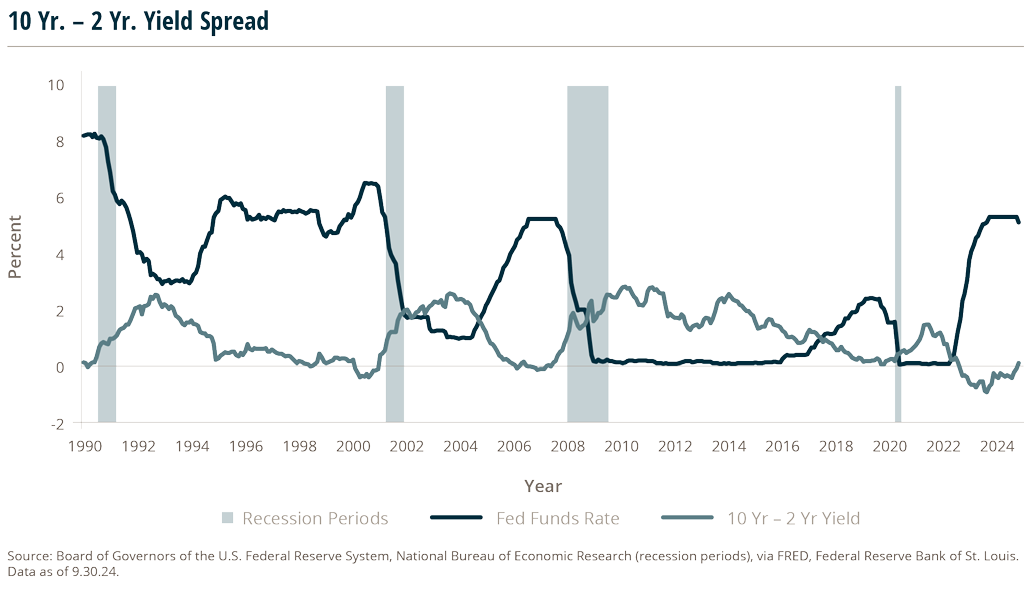

In early September, the yield curve “disinverted” (or normalized) after being inverted for over 2 years, beginning July 2022. An inverted yield curve happens when the yield on the longer 10-year Treasury note is less than the yield on the shorter two-year Treasury note. A disinversion (or reversion to the norm) often indicates that investors are expecting the Federal Reserve (Fed) to lower interest rates.

The yield curve represents the difference in the return investors receive when buying shorter-term debt (the 2-year Treasury) compared to longer-term debt (10-year Treasury).

In a normalized yield curve, the 10-year Treasury yield is higher than the 2-year Treasury. This is normal because investors generally expect a higher return for a longer commitment. When the yield curve inverts, it is often a sign of a weakening economy or impending Fed aggressiveness around interest rates. As the chart below reveals, the 2022 inversion did not signal a recession, but it did correspond to the Fed raising rates in an effort to control inflation and avoid a recession.

Now, with the yield curve recently disinverting, some analysts wonder whether this could signal an upcoming downturn, since disinversion often happens when the market starts to price in upcoming rate cuts or the Fed begins to lower interest rates. Because the Fed also often tends to ease policy when the economy shows some weakness, some are now pointing to the disinversion as a potential sign of a future recession.

Looking at the rate-cutting cycles since 1990 (excluding the COVID pandemic), the economy has, on average, entered a recession 18 months after the Fed first cuts rates.4 However, there is wide variation in the time between the first rate cut and a recession. For example, there was a prolonged period of 69 months from the start of the Fed rate cuts in July 1995 until a recession occurred, but a recession began only two months after the Fed started cutting in January 2001.

While there remains a risk of a future economic slowdown, many analysts believe the U.S. economy will avoid a recession, even as the Fed signals its intentions to continue cutting rates in Q4 2024 and into 2025, with many datapoints pointing to a soft landing and a strengthening U.S. economy. These datapoints include: U.S. GDP increased at an annualized rate of 3% in Q2 2024, which is above the 2.1% projected rate.5 September jobs data also came in better than expected, with 254,000 jobs added, compared to the forecast for 140,000 new jobs, bringing the unemployment rate down to 4.1%. Meanwhile, the major stock market indices, including the S&P 500, continue to climb to record highs.

Sources:

- https://www.ciab.com/dofine-printwnload/45285/?tmstv=1724084884

- https://www.leadersedge.com/p-c/property-casualty-hard-market-turns-6

- https://riskandinsurance.com/commercial-insurance-market-softens-in-q2-2024-ciab-quarterly-survey-finds/

- https://www.cnn.com/2024/09/23/economy/rate-cut-what-next/

- https://www.wsj.com/economy/us-gdp-economy-second-quarter-2024-485df1dc