Public Broker Performance Vol III, Issue 4

In this Section

MarshBerry Broker Composite Index: Market Update

During the period from January 1, 2024 to September 30, 2024, six public brokers, as measured by MarshBerry’s Broker Composite Index, saw a better return compared to both the Dow Jones Industrial Average (DJIA) and the S&P 500 index (GSPC).

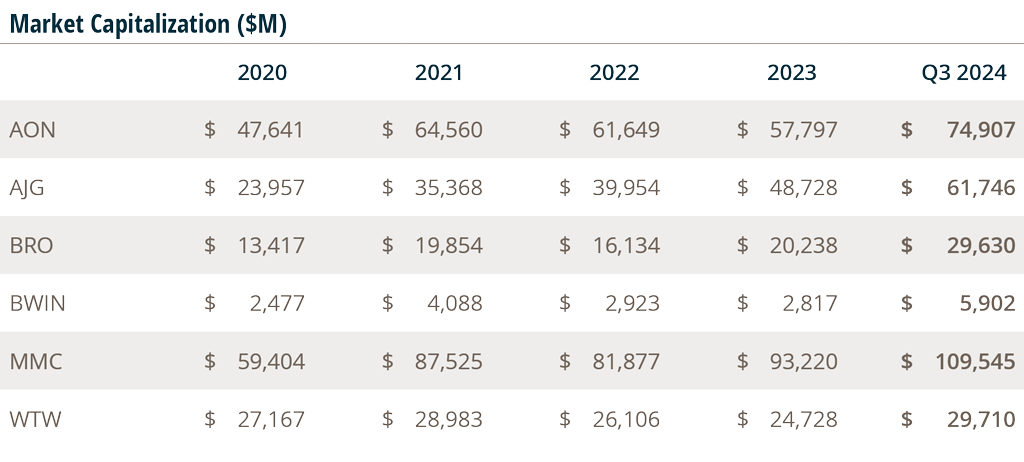

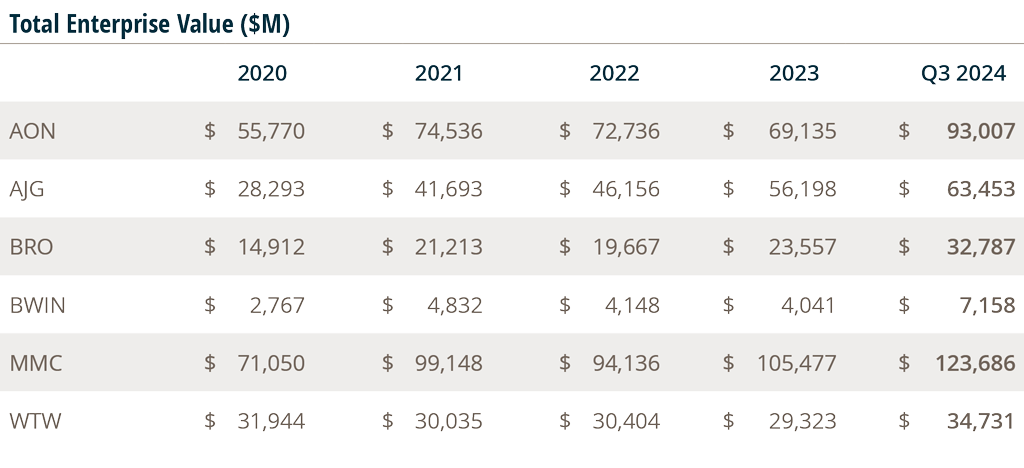

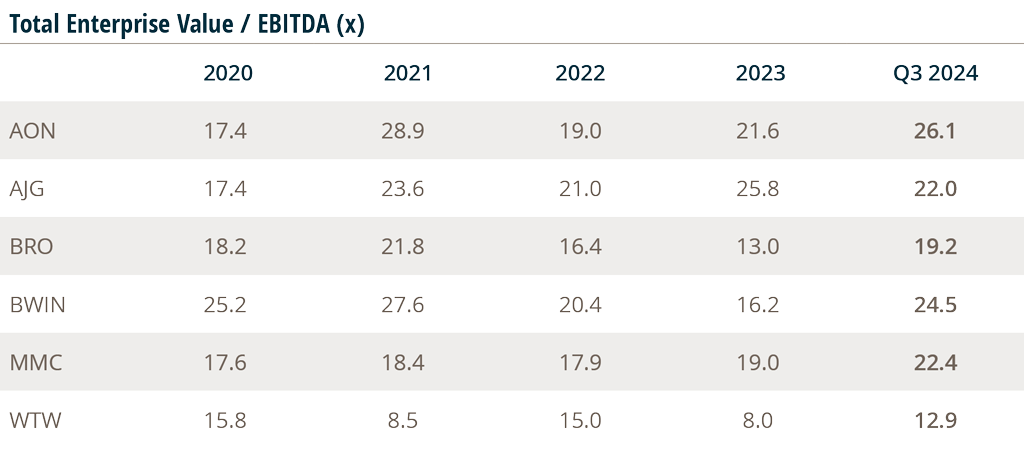

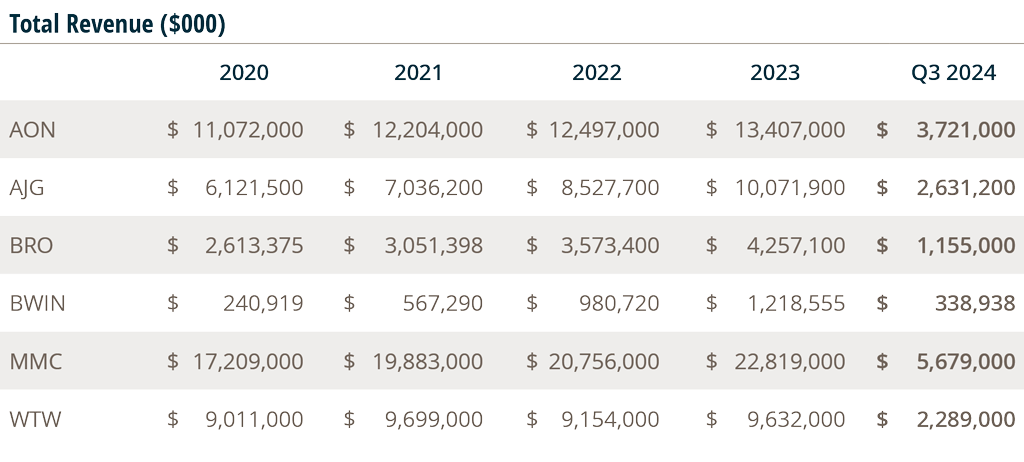

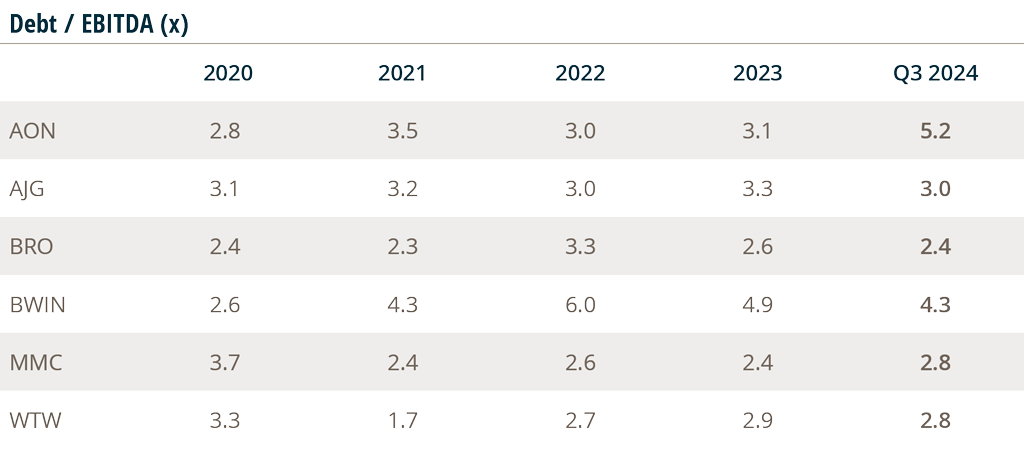

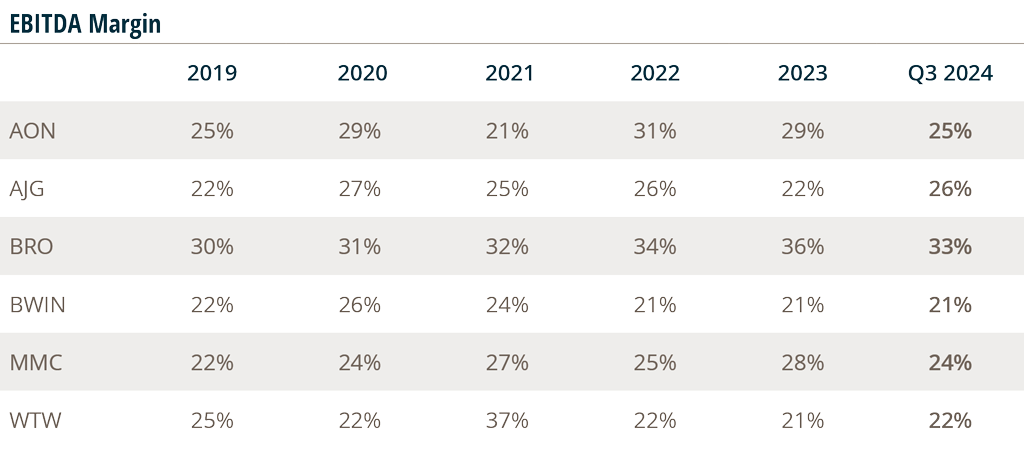

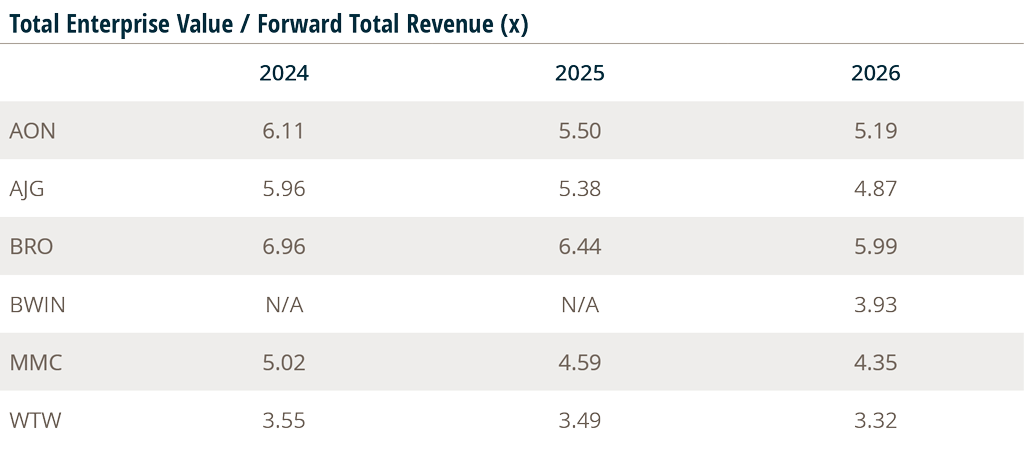

The following publicly traded insurance brokers are included in the Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and The Baldwin Insurance Group, Inc. (BWIN).

22.8%

Broker Composite

12.3%

DJIA

20.8%

S&P 500

Shares Of Public Brokers Continue To Show Strength

The share prices of the public insurance brokers outperformed the DJIA and GSPC through September 2024, driven by their ongoing strong revenue growth and profitability. Investors were also encouraged by the Fed’s first interest rate cut in over four years, as well as economic data that showed continued cooling inflation and better than expected GDP growth, with economists and investors seeing a soft landing for the U.S. economy, with moderating inflation and no recession.1 However, there are risks, including rising geopolitical tensions and the U.S. election in November, with potential consequences for trade, inflation, tax policy, and economic growth. Additional risks include future jobs data and economic growth coming in weaker than expected.

Following interest rate cuts at other global central banks, the Fed cut interest rates by 50 basis points at its September meeting, bringing the benchmark federal funds rate to a target range of 4.75% to 5%. Fed Chair Jerome Powell said officials have gained greater confidence that inflation is moving towards its 2% target and are now becoming attentive to both sides of the dual mandate (price stability and maximum employment). Fed officials also updated their projections for future monetary policy, with the median projection for the fed funds rate in 2024 of 4.4%, implying an additional 50 basis points of rate cuts for the last two meetings of 2024 (in November and December). The median fed funds projection for 2025 is 3.4%, down from 4.1% in June. Officials expect interest rates to settle around 2.9% in 2026.

While the public brokers have larger recurring revenue bases and are very resilient during economic volatility, their growth levels are also continuing to benefit from a stable economy, the ongoing hard rate environment, and exposure increases driven by inflation.

Public Broker Comps

Sources:

1 https://www.pimco.com/us/en/insights/securing-the-soft-landing

Source: S&P Global Market Intelligence, Company Reports, FactSet, 11.5.24. EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization. AON = Aon plc; AJG = Arthur J. Gallagher & Co.; BRO = Brown & Brown, Inc.; BWIN = The Baldwin Group; MMC = Marsh & McLennan Companies, Inc.; WTW = Willis Towers Watson Public Limited Company.