Industry Insights Vol III, Issue 4

Weighted Average Shareholder Age For Insurance Brokerages Continues To Decrease

While the WAOA of private insurance brokerage companies has been decreasing slightly over the last few years, many firms in the sector could still benefit from expanding ownership. Weighted average shareholder age (WASA) is the average of the shareholders’ age weighted by the percentage of stock they own, and a high result may indicate the need to transition stock or perpetuate ownership.

In 2019, the average WASA was about 56. This has decreased over the last four years, reaching 53.6 years in 2024. The decreases in 2020-2021 may have been caused by older brokerage owners retiring due to the recession during that period. Continued rising valuations over the last four years may have also led to older owners selling all or of part of their holdings.

Benefits Of A Lower WASA

According to data from MarshBerry’s proprietary financial management system, Perspectives for High Performance (PHP), firms with lower average shareholder age tend to have higher sales velocity and organic growth.

The firms with lower WASA (below the average of 53.6) most likely have specific strategies in place to share ownership with younger high-performing employees, giving them robust performance incentives. Younger shareholders also tend to hire younger producers; and firms with the highest organic growth rates tend to have higher percentages of younger producers.

Firms that have a higher WASA (above the average of 53.6) should consider investing time and effort into strategic equity succession planning. Broad ownership can motivate stakeholders to drive new business production and organic growth, potentially leading to higher firm valuations. A clear perpetuation strategy for key staff can also help create a strong feeling of purpose and motivation for the team. When leaders have a vested interest in the success and future of the firm, this can help drive performance and focus.

High growth firms that broaden ownership or build a strong equity incentive plan can drive higher EBITDA margins, build more internal collaboration, align interests to achieve growth goals, and build a strong story that attracts and retains top talent. If your goal is to perpetuate internally and control the decision to remain privately held, you may want to consider some of these steps.

Expanding Your Portfolio: The Pet Insurance Opportunity

Due in part to the pandemic pet boom, animal adoption (and expensive pampering) is on the rise. Currently, 66% of families in the U.S have some kind of pet. Comparatively, very few have pet insurance — only 4% of dog owners and about 1% of cat owners have some kind of coverage.1 With veterinary care costs rising at 10.6% every year, pet insurance is an untapped market with great potential for expansion.2

The Pet Insurance Landscape

Typically covering expenses such as medicine, surgery, accidents, or illnesses, pet insurance has expanded due to expensive advancements in animal medicine, such as progressive medical treatments, diagnostic procedures, and specialized care. There are roughly 30 pet insurance companies in the U.S. with Lemonade, Spot, and Embrace emerging as industry leaders. Non-insurance companies have started offering coverage as well, such as ASPCA and Petco.

Market growth numbers are high for the pet insurance industry, with many global forecasts putting the market value at $18 billion by 2033 and some sources predicting even higher numbers.3

Specific reasons for the product’s growth potential include:

- Well-known companies like MetLife, Nationwide, and Allianz are offering pet insurance, which can be more reliable and secure than startups or unknowns. (Other major carriers, such as Allstate and Geico have a partnership with Embrace, Progressive partners with Pets Best).

- It’s not just for cats and dogs, some insurance companies are covering other pets, such as horses. Nationwide even covers exotic pets like snakes and pigs.

- Pet medical insurance has broad functions and offers specialized programs that attract more customers, such as coverage based on pet age or breed.

- Veterinary care is becoming more expensive and with an estimated price tag of $39.1 billion this year, pet owners are seeking alternate means to afford medical treatments.4

- Some pet insurance products offer partnerships with healthcare technology, such as remote exams and wearable devices, leading to more comprehensive and convenient care that appeals to customers.

According to The North American Pet Health Insurance Association (NAPHIA) pet health insurance in the U.S. grew 21.9% last year5 and some insurers have been approved for rate increases of 20% or more.6

Recommendations For Insurance Brokers

Brokers who add pet insurance to their product lineup will benefit from diversified revenue streams and enhancing their firm’s value proposition. The average cost of pet insurance is $51 per month for dogs and $27 per month for cats7, but premiums are steadily rising. This is partly due to hard market conditions and high inflation. Some brokers are using pet insurance to differentiate their firm and reach additional audiences in marketing campaigns. The top reason pet owners say they don’t have insurance is lack of awareness, not lack of interest. Therefore, brokers have an opportunity to educate their clients on available pet-based insurance products and their value, leading to improved client satisfaction and loyalty.

While every insurance product comes with unique challenges, pet insurance is worth exploring. Since workplaces, hotels, and even stores are becoming more pet friendly, pet insurance has potentially significant benefits for both clients and brokers.

Causes And Effects Of Costly Auto Insurance

Although the rate environment is showing signs of softening, auto insurance rates remain one of the most elevated. Car insurance premiums increased 24% in 20238 and 9% for commercial auto in Q2 of 2024 alone.9 Q2 2024 was also the first time in two years that commercial property insurance didn’t reflect the highest average increase among commercial lines.10

Q2 2024 earnings calls for some of the larger P&C brokers were dominated by talk of the excellent revenue brought in from personal auto lines. Progressive’s personal line revenue (93% auto) increased 21% to $13.8 billion from $11.4 billion a year ago. Net premiums written grew 26% year-over-year to $14.56 billion from $11.6 billion. Also reflecting top numbers was Allstate, with net written premiums increasing 12.3% year-over-year to $9.3 billion from $8.3 billion.11

This chart shows how, over time, these costs have risen faster than the rate of general inflation.

Why auto insurance rates continue to increase

Aside from general economic conditions and inflation, there are other factors contributing to the soaring cost of auto insurance.

- Poor driver behavior: Distracted and aggressive drivers are causing more frequent accidents and an increase in claim payouts. Those who focus on their phone instead of the road cause accidents and damage that cost $40 billion a year.12

- High crime: Vehicle theft rates have been increasing since 2019, reaching a record high of 1,020,729 vehicles in 2023.13 Also becoming more common is theft of car parts, with catalytic converters the top target of criminals.

- Natural disasters: Hurricanes, floods, and fires are damaging vehicles at an alarming rate. Weather-related claims reached $60 billion in 2023 alone.14

- Supply chain issues: A shortage of materials slowed car manufacturing and repairs, causing increased prices for both new and used cars, and replacement values, contributing to more expensive insurance.

- Expensive and complex repairs: As vehicles become more advanced, they require more complex repairs handled by workers with specialized skills. This means more training, complicated equipment, and higher salaries for experienced laborers, leading to greater costs across the board.

- Excessive lawsuits. Commercial auto in particular is more prone to substantial legal judgments, also known as nuclear verdicts, affecting everything from policy pricing to underwriting.

As a result of these issues, insurance companies must recoup the costs of claim payouts by raising premiums. Minimum liability auto insurance requirements vary from state to state, but is legally required for all vehicles, making the rising cost a financial burden for many.

Impacts Of Elevated Auto Insurance Costs

With premiums on the climb, it’s becoming increasingly difficult to afford this essential coverage. But for both brokers and consumers, it’s not an entirely negative situation.

- Hard market opportunities: High premiums result in high commissions so it’s a good time for brokers to focus on growth mechanisms, like bringing in new talent, evaluating culture, or adjusting marketing strategy. For policyholders, higher insurance revenue often means that the insurance company is better able to cover claims in the event of an accident or other covered loss.

- Increased use of ride share: Alternative transportation like public transit and Uber or Lyft helps keep costs down for consumers, but there are also advantages for the insurance industry. Uber released a statement: “Our business depends heavily on insurance coverage for drivers and on other types of insurance for additional risks related to our business,” and noted that they purchase a variety of coverage types.

- Decrease in teen drivers: More teenagers are delaying getting their driver’s license which reduces insurance costs for families since younger drivers tend to be more expensive to cover. This is also good news for insurance brokers as they are considered high-risk, and it can be tough to find policies with appropriate coverage that also meet clients’ financial needs.

Auto insurance premiums are showing signs of stabilizing and far smaller increases are anticipated in the next year. While still profitable, this business line may look different in the near future.

Best Practices For Insurance Brokers

Be transparent with clients about the economic climate and educate them about the broader industry. Proactively exploring opportunities to save and reviewing coverage needs can instill trust and prevent client loss.

Discounts and special programs are becoming more common and specialized. For example, Allstate offers Drivewise, a technology that creates auto insurance rates based on how safely a user drives. Amica offers StreetSmart, which offers insights into your driving habits and ways to become a safer driver. Other safe driving apps include Geico’s DriveEasy and Progressive’s Snapshot. Focus on retaining clients by preparing your staff with solutions and ensure they can state value propositions clearly.

Top Heavy: The Top 100 Insurance Brokers In The U.S. Continue To Get Bigger

The 2024 Top 100 Insurance Brokers in the U.S. list continues to be top heavy from intense consolidation and continued P&C rate hardening – producing double-digit organic growth. The top 50 brokers represent 96% of all the revenue on the list, while the average annual growth rate of all firms was 15.0%.

The complete list was published by Business Insurance in their annual report on the Top 100 Insurance Brokers, which is ranked by U.S. revenue for 2023.

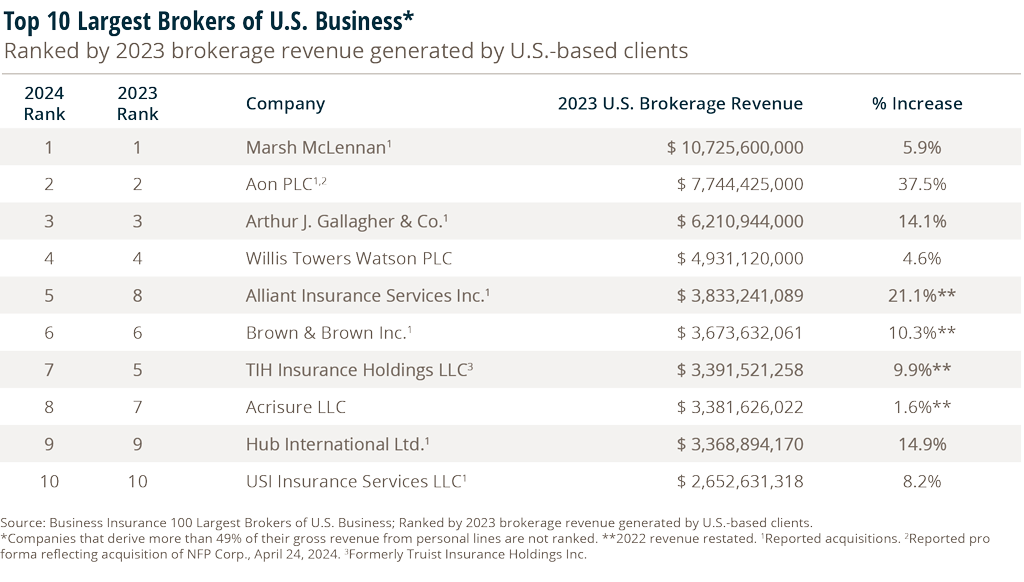

This year, the top 10 U.S. brokers’ revenue totaled a resounding $49.9 billion and represents 66% of the total top 100 revenue ($75.5 billion). And for the fifth year in a row, the top 10 firms are exactly the same, with only slight shifting of positions over that span.

While the top 100 and top 10 firms grew by 15.0% and 12.8% year-over-year (YoY) respectively – the percentage of revenue for the top 10 has actually trended down over the last few years – due to more growth in the 11-50 firms.

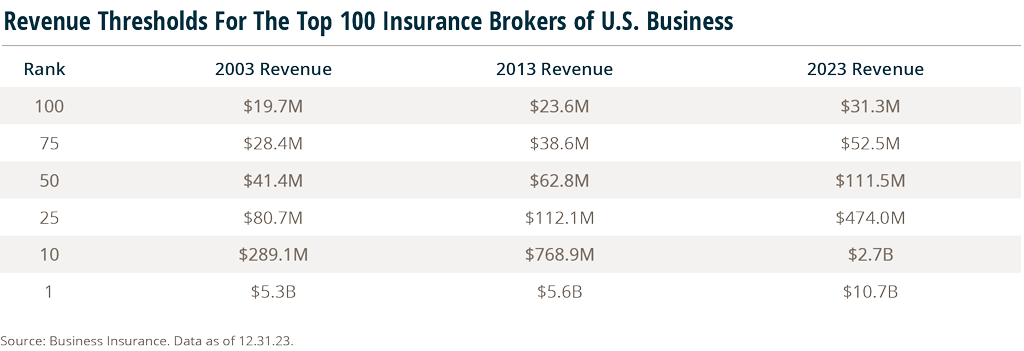

Even so, to enter the top 10 U.S. insurance brokers’ bracket a firm would need a staggering $2.7 billion in revenue. This is compared to just $768.8 million needed 10 years earlier in 2013, a 245% increase in this revenue threshold.

Takeaways From The Top 50

The top 50 firms in 2023 represent $72.5 billion in revenue – which is 96% of the total revenue for the top 100. In 2023 a firm needed over $111.4M to break into the top 50, a 78% increase in this revenue threshold vs. 2013 when firms needed $62.7M to get into the top 50.

There is a clear growth trend dividing the top 50 (with 96% of the total revenue) and the bottom 50 (with 4% of the total revenue) on the top 100 list – especially for the 11-50 ranked firms. The average CAGR for the 11-50 firms are significantly higher than the 51-100 ranked firms. The average 5-year CAGR for firms ranked 11-50 is 17.6%. But for firms ranked 51-75, the CAGR drops to 9.5%. And drops even further for firms ranked 76-100 with 4.7% CAGR. This speaks volumes to how quickly and consistently these larger firms are growing, and how challenging it is for smaller firms to be consistent in their growth in order to keep pace.

This challenge for the bottom 50 firms also represents an opportunity for other firms, on the outside, looking in, to break into the top 100 list.

Opportunity To Enter The Top 100?

While the overall YoY revenue growth of the combined top 100 firms was 13.5%, it’s interesting to note that 35 of those firms individually failed to grow by double digits in 2023. Of the 35 firms that failed to grow by 10% or more, 20 of them were ranked in the bottom 50.

For firms on the outside, looking in – this is where the opportunity for entry is relatively open. The barrier for entry into the Business Insurance’s Top 100 hasn’t risen significantly in the past ten years. A broker needed $23.6M to enter the top 100 in 2013. Today – they would need $31.3M (only a 33% growth in revenue since 2013). A significant task for many firms, but not impossible to imagine.

How Can Firms Grow And Compete If They Aspire To Make Or Remain On The List?

Sustainable organic growth fueled by predictable sales velocity continues to be the most controllable method for taking a firm to the next level – for increasing revenue and for attracting possible partners. Here are common strategies that firms of all shapes and size should address.

- Reassess your capital structure to build capacity and capital for growth.

- Re-think your risk tolerance as it relates to debt and leverage.

- Deliver a process driven new client acquisition strategy.

- Embrace aggressive new business goals and real production accountability.

- Build industry vertical specialization supported by data analytics.

- Double down on hiring new production talent.

- Design a wealth creation perpetuation plan to attract and retain talent.

Building a cultural commitment to an organic growth strategy, identifying potential best-in-class brokerage partnerships, and doubling down on opportunities for reinvestment (capital, talent) can be keys to the future outlook and success of firms that wish to compete to make the coveted Top 100 Broker List.

Sources:

- https://www.forbes.com/advisor/pet-insurance/pet-ownership-statistics/

- https://money.com/pet-insurance-costs-rising-2023/

- https://www.insurancebusinessmag.com/us/news/breaking-news/pet-insurance-market-set-for-doubledigit-growth-489862.aspx#

- https://capitaloneshopping.com/research/pet-spending-statistics/#

- https://naphia.org/news/soi-report-2024/

- https://money.com/pet-insurance-costs-rising-2023/

- https://www.forbes.com/advisor/pet-insurance/pet-insurance-cost/

- https://www.cbsnews.com/news/car-insurance-rates-inflation-costs/

- https://www.insurancejournal.com/news/national/2024/08/20/789202.htm#

- https://www.capitaliq.spglobal.com/apisv3/spg-webplatform-core/news/article?

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-p-c-q2-24-earnings-recap-personal-auto-drives-the-agenda-

- https://www.thezebra.com/resources/research/distracted-driving-statistics/

- https://www.marketwatch.com/guides/insurance-services/car-theft-statistics/

- https://insurify.com/car-insurance/why-your-car-insurance-costs-are-so-high/