Focused Insights: The Future of Internal Perpetuation: Is The Independent Brokerage Model Going Extinct? Vol III, Issue 4

Less and less firm owners are talking about selling their business internally. On its face it seems like a disturbing trend, but maybe it’s okay.

The American dream is based on the idea that anyone can achieve success through hard work, determination, and perseverance. Starting a business is often considered the quintessential example of the American dream, where an individual can be their own boss, control their own destiny and build something important and valuable. For many, when the time is right, that also may lead to an opportunity to cash in and sell that business. However, in the insurance brokerage industry, this is sometimes looked at as “selling out.”

For decades, insurance firms have often been family-run businesses, passed down through generations. Children frequently followed in their parents’ footsteps, taking over the firm and maintaining its independent status. This tradition fostered a sense of continuity, trust, and personalized service that resonated with clients. This model continues today, with many independent brokerages proudly displaying their company name identifying the family that owns it.

And for many brokerage owners, there is still pride in proclaiming that their business will remain independent by perpetuating to the “next generation” – whether that be family or other trusted leaders of the business. But more often than not, this prideful proclamation has become a hollow promise.

In this current environment of high valuations and heavy consolidation, the topic of internal perpetuation, or how to remain independent, has become less and less of a priority for firms.

In 2014, 17.6% of firms had ownership transfers of greater than 10%. In 2023, that figure dropped to 10% of firms.1

Why Has Internal Perpetuation Become Less Attractive?

According to MarshBerry’s proprietary database, and other publicly available databases, approximately 7,100 insurance brokerages have sold over the past ten years (a 10-year CAGR of 6.8%). The prior ten years saw less than 3,000 brokerages sold (with a 10-year CAGR of 2.6%).

While much of this increasing trend in consolidation reflects those taking advantage of current market conditions and firm valuations at all-time highs, many times the selling of a firm can be traced back to the moment ownership recognizes that internal perpetuation may not be possible.

Today many insurance brokerage owners find themselves in a mental struggle over the decision to sell externally or to try to remain independent by perpetuating internally.

Over the last several years, the landscape of insurance brokerage ownership has undergone a significant transformation – one that has seen fierce competition, talent shortages and extreme pressures to grow year-over-year. Many owners have become focused on the crucial operational challenges in order to reach those growth goals, distracting many from their plans for how to continue their independence through internal perpetuation.

However, the primary reason for this diminished interest in internal perpetuation is because of the valuation gap that continues to widen.

What Is The Valuation Gap?

The discrepancy between external and internal value is often referred to as the valuation gap. But most don’t understand this. Why would a business be valued at a higher price for an external buyer than for someone who’s been working at your business for years and wants to become its owner? This is a point that confuses many owners, even those who have been in the business for decades.

There are a countless number of variables that figure into what a buyer will actually pay for a business. And there are different variables involved in determining the value for these two audiences. Additionally, since the end goal is different for each potential buyer, the strategy to prepare for these two different types of sales may be different.

Primarily, the difference in value lies in the level of profitability and the multiple a buyer can, or be willing to, pay. At its most basic – an external buyer may simply have strategic motivation for paying more, have better access to capital and be able to afford to pay a higher multiple on the profit. Internal buyers may not have the ability to pay what an owner wants or may need cash flow to finance the debt that enabled the transaction.

In the end – the gap between what a firm might be valued if sold internally versus what it might fetch if sold externally can be upwards of 50-100% more.

A Different Mindset: Perpetuating Internally Vs. Selling Externally

As the life cycle of a privately-held insurance brokerage progresses, owners inevitably recognize that an eventual transition of ownership will need to take place. Questions begin to surface around the various routes available to preserve the firm’s legacy. Many, however, fail to consider a more crucial question: Have they positioned the firm from a financial, cultural, and organizational standpoint that aims to maximize shareholder value and sustain the firm’s legacy?

Internal perpetuation is a mindset or a philosophy on a culture that is embedded in an organization committed to constant improvement. Firms that are committed to perpetuation are highly focused on organic growth, improving margins, increasing value, developing leaders, recruiting talent and improving processes. For internal perpetuation to work, employees need to be excited about investing in the firm for the long term.

The vast majority of insurance brokerage owners identify their long-term solution to perpetuating their business with a plan to structure an internal transaction. However, internal perpetuation is very challenging and complex, and requires firms to start much earlier than they actually do. As a result, most firms end up selling or partnering with another firm externally, because the fact is, firms without a perpetuation plan will eventually have to sell.

And when an owner ultimately decides to sell externally, their moves are usually focused on improving the proforma to help drive up the value, with the goal of making the business more valuable on paper. However, firms who have long ago run their business with a focus on constant improvement and long-term value creation, will already have the advantage if they choose to sell. They have already made their business attractive to new hires, existing employees and potential future shareholders, by creating the right sales culture and planning for growth. Buyers like companies with a perpetuation plan.

Remaining Independent: Actions Speak Louder Than Words

For many owners, the proclamation of remaining independent is a promise that has become more and more difficult to keep. An owner can’t wake up one morning and confidently decide to retire and hand over the reins to family members, or ask senior leaders to buy them out, without a plan for it.

A plan for long-term sustainability and perpetuation of a business should be viewed as a continuous process with neither a beginning nor an end. Firms need to have strategies around the most important ingredient – people. They need to recruit top talent, build a sustainable sales culture, create training and mentorship programs, and retain top employees through ownership opportunities.

But most firms have not made the commitment or necessary preparations to make continued independence possible. Any commitment often gets pushed aside or delayed for other priorities. The harsh reality is – perpetuation requires continuous commitment and investment in people and processes – a commitment many can’t keep.

In a MarshBerry study, firms were asked if they believed their next generation of leaders were capable of taking over the firm. An overwhelming majority (79%) stated “yes.” However, when asked if they offered an ownership strategy to key employees, an equally overwhelming majority (77%) said “no.” So, even though most owners believe they can perpetuate, most are not actively doing something to achieve it.

Source: MarshBerry Market Pulse Study, May 2021.

According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP), ownership in insurance brokerage is still too concentrated with the older generation. The weighted average owner age (WAOA) of insurance ownership is approximately 54 years old, with 80% of shareholders at 44 years of age or older, and only 20% of shareholders under the age of 44.

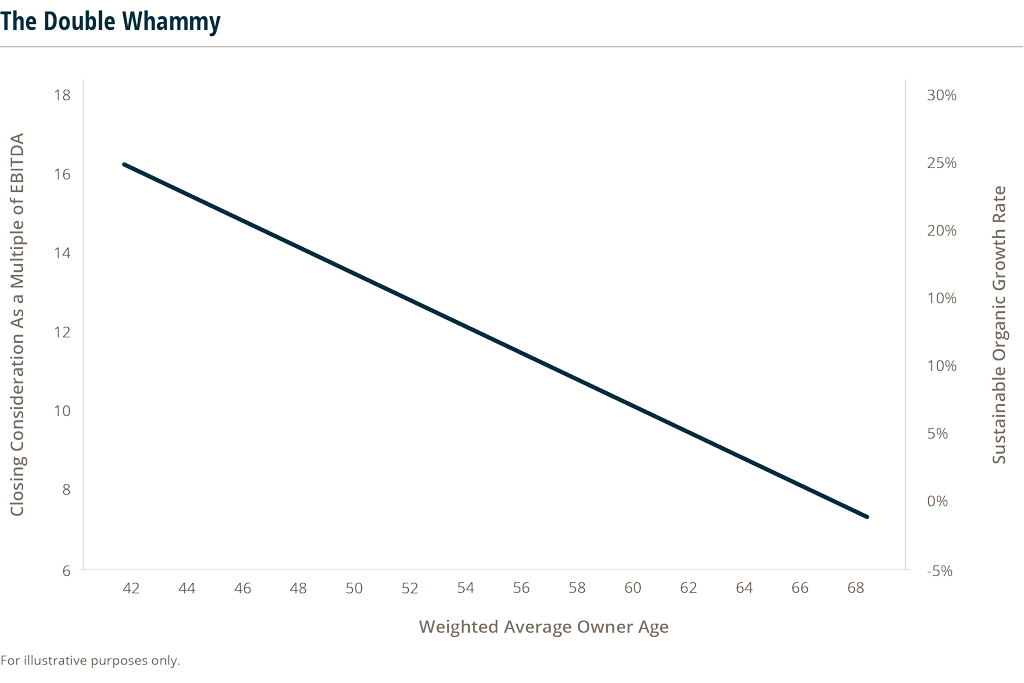

There is a direct correlation between WAOA, sustainable organic growth rate and firm valuation as a multiple of earnings before interest, taxes, depreciation & amortization (EBITDA). The higher the WAOA, the harder it becomes to sustain organic growth, and achieve maximum valuation at time of sale.

Talking about remaining independent means nothing without a plan. Having a perpetuation plan in place that includes smart recruiting and retaining the best talent through ownership programs, keeping WAOA low, can help a firm’s valuation whether they decide to perpetuate internally or sell externally.

Why Do Owners Still Want To Internally Perpetuate Their Business?

With all of the challenges associated with perpetuating a business to internal stakeholders, and increased opportunities to sell externally, why do owners still dream of remaining independent? Often, it simply comes down to personal preference. Everyone will have a different reason, ranging from desire to fulfill a legacy, to the ability to maintain control.

The fact is, in today’s market the average firm is growing by double digits each year, and it is becoming more and more challenging to remain competitive. Firms need to find ways to grow, either through a combination of specialization or geographic expansion and acquisitions. Because of this, many owners look toward an external sale or partnership with another firm, simply because it allows them to remain competitive and to continue (or accelerate) their growth.

This realization of the evolving marketplace, compounded by the level of effort to ensure independence has shifted the mindset of owners. Many still may believe they can remain independent, but few are proclaiming it openly – for fear of breaking their promise.

So rather than struggle with the question of “should I stay independent or sell out”, owners should continue to focus on the questions of what investments are needed to continue to help their business compete at a high-performing level.

If you dedicate time and resources to improving your business operations with a mindset toward its long-term health and success you can put yourself in a position where you will have a choice. You will have the option to internally perpetuate to the next generation, or you will be able to sell externally for a high price to a partner of your choosing.

The reality is – everyone will eventually need to transfer ownership of their business. It’s not if – it’s when. MarshBerry often points out that if you run your business like it’s for sale, you may never have to sell externally.

There Is Still A Place For The Independent Broker

The independent brokerage model isn’t going extinct. For every firm that sells, there’s a new brokerage that pops up. But when that brokerage reaches a certain size or reaches a point where the business needs to take on additional risk to grow further – decisions need to be made. Owners are no longer talking about internally perpetuating their business like they used to, but it is not because it is not possible. MarshBerry has many clients that are committed to internal perpetuation. However, in todays’ marketplace many brokerages are making the decision to sell their business or take on a capital partner, which is okay – because either choice is simply part of the business owners’ American dream.

Sources:

- MarshBerry proprietary financial management system Perspectives for High Performance (PHP).