Public Broker Performance Vol III, Issue 3

MarshBerry Broker Index

Get the latest performance and insights on the public broker composite.

Marshberry Broker Composite Index: Market Update

During the period from January 1, 2024 through June 30, 2024, six public brokers, as measured by MarshBerry’s Broker Index, saw a better return compared to the Dow Jones Industrial Average (DJIA). The S&P 500 index (GSPC) outperformed both the Broker Index and the DJIA, with a 14.5% return for the same period.

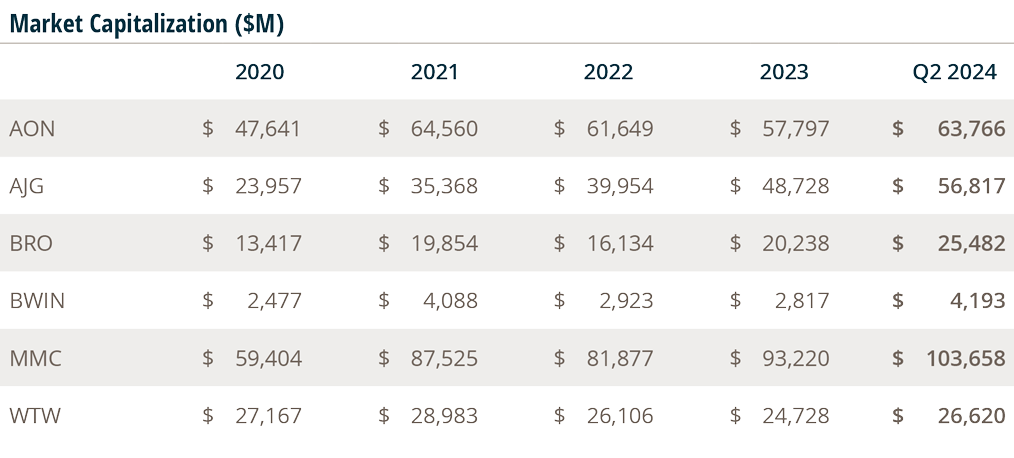

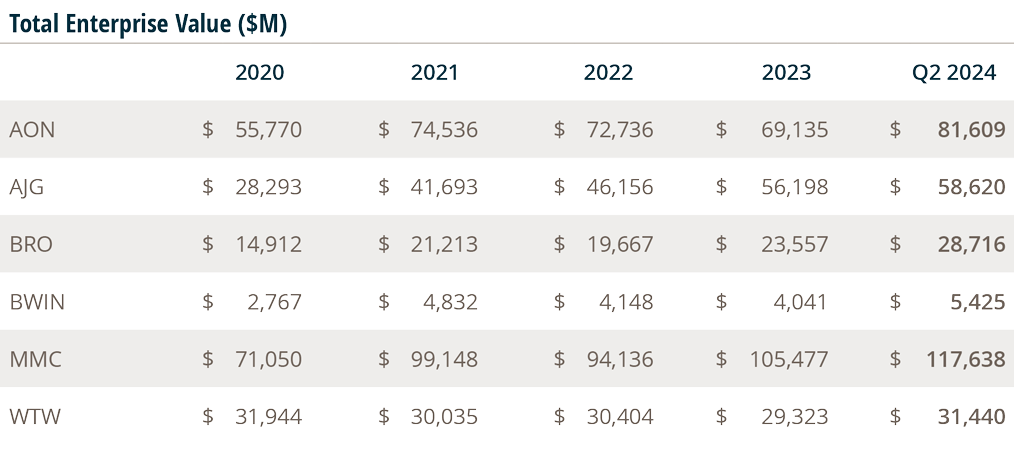

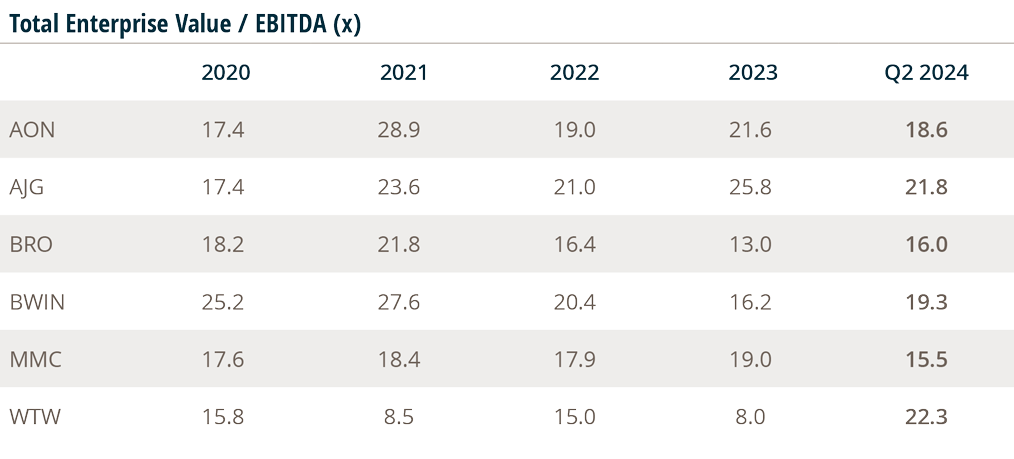

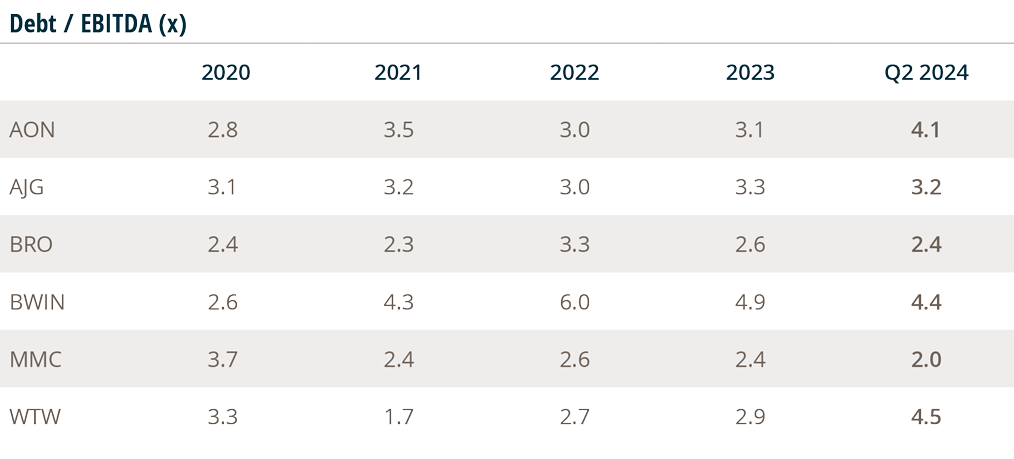

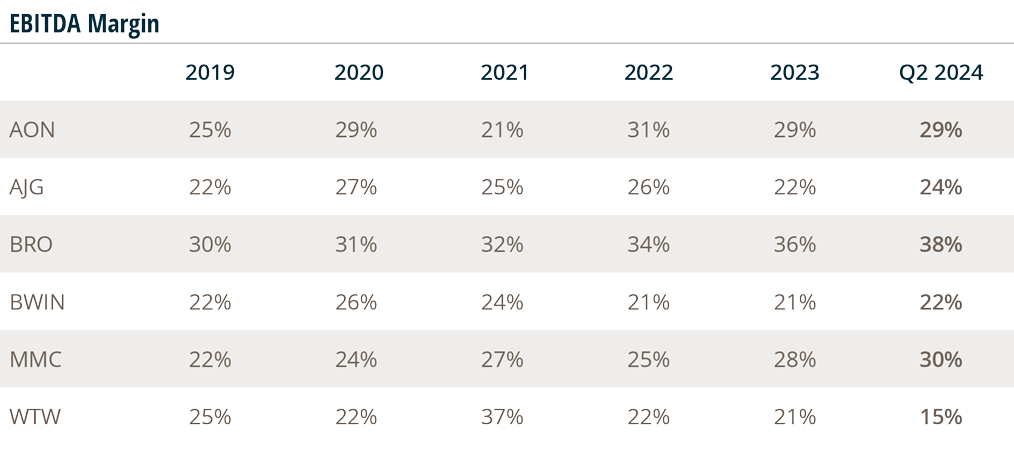

The following publicly traded insurance brokers are included in the Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and The Baldwin Insurance Group, Inc. (BWIN).

10.1%

Broker Composite

3.8%

DJIA

14.5%

S&P 500

Shares of Public Brokers Continue to Advance

The share prices of the public insurance brokers continued to advance through June 2024, helped by positive economic data and strong business results.

Investors were encouraged by data in June that showed cooling inflation and resilient growth, with economists more confident that the U.S. economy will have a “soft landing,” where the central bank can slow growth and curb inflation without causing a recession.1

One of the key inflation measures (core personal consumption index) for the U.S. Federal Reserve (Fed) showed that May 2024 inflation fell to the lowest annual rate since 2021. The core Personal Consumption Expenditures (PCE) price index increased 0.1% on a monthly basis and 2.6% year- over-year, in line with Dow Jones estimates. Furthermore, June’s CPI decreased 0.1% from May, declining for the first time since May 2020.

Global central banks have also begun easing interest rates, with the ECB announcing it would cut its main interest rate from 4% to 3.75% in June 2024. The Bank of Canada also cut its main interest rate in June. While the Fed maintained the benchmark federal funds rate in a range of 5.25% to 5.5% at its June meeting, recent data around moderating inflation has investors hopeful for a potential rate cut in September. According to the CME FedWatch tool, there are 93.3% odds that the Fed will lower its federal funds rate by a quarter percentage point in September.2

While the public brokers have larger recurring revenue bases and businesses that are noncyclical, their growth levels are also continuing to benefit from a stable economy, the ongoing hard market with higher insurance rates, and ongoing strong demand.

Public Broker Comps

Sources: