M&A Market Update Vol III, Issue 3

The Latest Deals and Insights

Who’s buying? Who’s selling? MarshBerry highlights the current M&A market and provides a look at recent transaction activity.

A Strong First Half Signals A Possible Banner Year For Insurance Distribution M&A

At the halfway point in a year that was economically prophesied to unfold in multiple ways – 2024 may be starting to finally come into focus. Late in 2023, there were predictions for an economic recession in 2024, but these were revised several times as inflation fluctuated, and the Federal Reserve Board’s (Fed) proposed interest rate cuts were kicked down the road.

With the most recent reports of a cooling job market and easing inflation, talks of changes to monetary policy at the next Fed meeting (in late July) are starting to heat up again. However, financial experts and policymakers still believe any decision on rate cuts would occur during the September meetings or later.

For the insurance brokerage world, the relative stabilization of commercial property and casualty (P&C) rates at the end of Q2 may be more of an economic indicator for what the rest of the year and beyond holds. According to MarketScout, overall commercial P&C rates increased 4.4% in Q2, slightly more than Q1’s increase of 3.9% – but less than Q2 2023’s 5.0% increase.

And based on the most recent USI Commercial Property & Casualty Market Outlook Mid-Year Addendum report, the second half of 2024 should see continued stabilization of rates across most product lines.1

If this trend of “stabilization” continues, or even decreases in rates occur, there may be some concerns about the ability for brokers to maintain this level of organic growth, as brokers have certainly benefited from 26 quarters of commercial P&C premiums increases. In order to continue maintaining that level of growth, firms will need to focus more on their new business sales velocity and existing client retention.

For M&A, the first half of 2024 continues to trend towards a possible banner year. Traditionally, the first half of the year only represents around 30% of the eventual total number of deals.

For comparison, at the mid-way point in the record-breaking year of 2021 there were 314 announced M&A transactions, or 29.5% of the final total of 1,066 deals. In 2022, 237 deals (or 26.2% of total deals) were announced by the end of June. And for 2023, there were 271 deals (or 33.5% of total deals) at the mid-way point.

As of June 30, 2024, there have been 303 total announced transactions. If the trend of “30% at mid-year” holds true, we could be staring at close to 1,000+ M&A transactions in the U.S. in 2024.

M&A Market Update

The 303 announced insurance distribution M&A transactions in the U.S. through June is an 11.8% increase in total deals compared to this time in 2023, which ended Q2 with 271 announced transactions.

Private capital-backed buyers accounted for 226 of the 303 transactions (74.6%) through June. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies accounted for 42 deals so far in 2024, representing 13.9% of the market, a slight decrease from 2023 when independent agency acquisitions represented 15.6% of the market. Transactions by bank buyers continued to fall as a percentage of overall deals, declining from 18 total transactions in 2022 to nine total transactions in 2023 – an all-time low. Bank buyers have recorded only two transactions in 2024, representing less than 1% of the market.

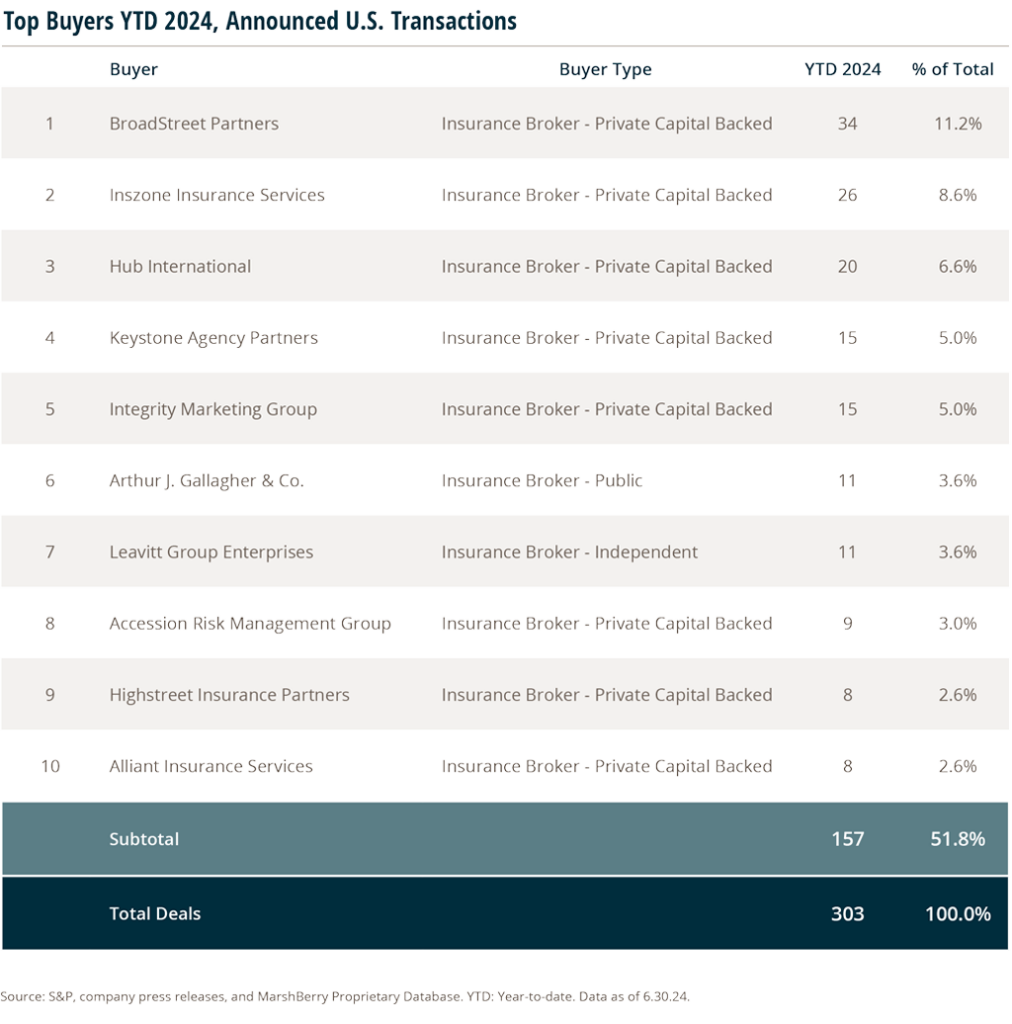

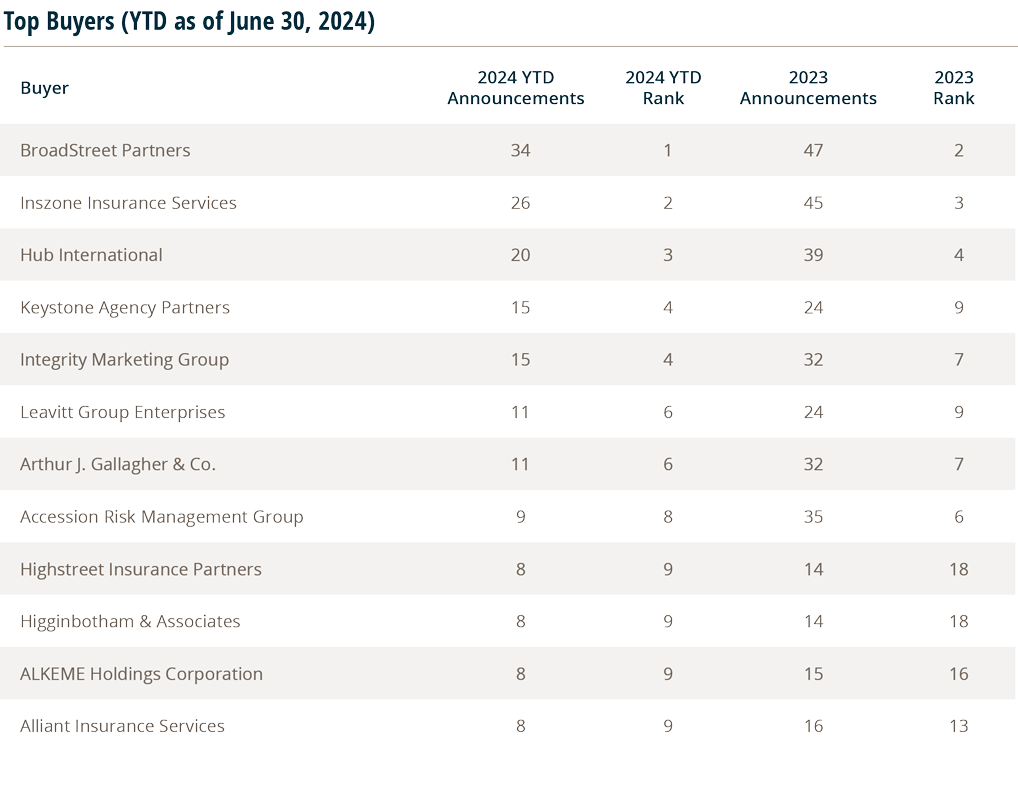

Deal activity from the top ten buyers accounted for 51.8% of all announced transactions through June, while the top three (BroadStreet Partners, Inszone Insurance, and Hub International) accounted for 26.4% of the 303 total transactions. For comparison, the top 10 buyers in all of 2023 accounted for 41.9% of total transactions, with the top three representing 16.2%.

Notable transactions:

May 2: Hub International Limited acquired Merriwether & Williams Insurance Services, Inc. Merriwether & Williams, based in San Francisco and Los Angeles, offers contractor development and bonding programs, risk management, special project consulting, and insurance brokerage services. This acquisition aims to enhance Hub’s risk and insurance capabilities for clients in both the private and public sectors, promoting small and diverse business engagement in public agency work. The company will now operate as Merriwether & Williams Insurance Services, Inc., a Hub International company.

June 10: AmeriLife Group, LLC acquired Succession Capital Alliance (SCA), a leading provider of advanced life insurance solutions and the innovator behind premium financing for life insurance. The terms of the deal were not disclosed. Founded in 2004, SCA is renowned for its proprietary Capital Maximization Strategy℠, which finances life insurance premiums through custom loans tailored to clients’ unique circumstances. This strategy has helped financial professionals place over $60 billion in life insurance and $6 billion in financed life premiums. SCA’s approach, along with its strong relationships with top carriers and financial institutions, has distinguished it in the high-net-worth market.

June 24: Arthur J. Gallagher & Co. acquired Norwalk, Connecticut-based OperationsInc, LLC. Terms of the transaction were not disclosed. OperationsInc is a consulting firm providing comprehensive solutions in human resources, payroll and human resources information system (HRIS) services, talent acquisition and employee training to clients of all sizes across the U.S.

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2024 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.