Focused Insights: Is Your Firm Ready For a “What If” Scenario? Vol III, Issue 3

Many insurance brokers have been living in utopia for several years – where outsized financial performance has been enhanced by of prolonged exposure base growth, hardening rates and unprecedented capital market support. But is the quality of growth (QoG) for these firms strong enough to withstand less than utopian market conditions?

The expression “better lucky than good” describes the broad success of many insurance brokerages during this unprecedented stretch of hard market conditions and economic expansion. The byproduct of which has been organic growth rates at all-time highs. Essentially, a veritable utopian universe. However, what would happen if this utopian world dissipated, and the cyclical nature of the rate cycle swung back? More than likely, it would force many firms to take a serious look at their business model and sustainable growth strategy. For many, if not most, it would be too late. Is your firm ready for such a “what if” scenario?

“What If” Economic And Market Conditions Were Less Than Utopian?

What if a flat economy (or worse a recession) and flat rates (or worse a soft market) collided with elevated interest rates and higher costs of capital. What would be the ripple effect? It could be very ugly. If organic growth was less than the cost of capital by a large margin, the world we know today would likely be the polar opposite with respect to supply and demand, buyer cash flow, mergers and acquisitions (M&A), debt capital market support and valuation multiples.

If we were not living in utopia and organic growth was a fraction of what it is today, and substantially below the cost of capital, times might be drastically different. Some private equity (PE) funded brokers could be facing severely reduced cash flow while some highly levered might be suffering from deficit cash flow. In the extreme, unraveling could create technical covenant defaults, and even worse, some principal and interest defaults. In this world, the perception of the insurance brokerage industry by the investment community and debt capital providers might be viewed as vulnerable rather than invincible. Which could mean un-bankable. This could prompt some to trade to strategics, while others might even need to scramble onto preferred equity life preservers. But in the extreme, many common shareholders would likely suffer.

What if today, hindsight suggested that the 15-year run up in valuations was not a new normal or a plateau – but a bubble. And if that bubble burst, and valuation mulitples dramatically reversed, the industry may look back with a mixture of fondness (for what might have been) and regret (in our false sense of security).

Except for the few. The few that knew it was all timing and prepared for the inevitable by building disciplined processes to drive predictable, profitable organic growth in any market condition.

“What if” isn’t just a playful look at what life would be like if an unrealistic, extreme and alternative reality occurred. It is the cold hard truth that the insurance industry has been the beneficiary of living in utopia. While uncomfortable to do so, every insurance brokerage leadership team should look in the mirror and ask if they are truly prepared for the future.

Are you prepared for “what if?” What if the world becomes normal again and there is no bail out by a hard rate environment concurrent with an economic and inflation induced exposure base runup? If market conditions change, is your “real organic growth” (organic grow excluding growth in rate and exposure base) higher than the cost of capital? Are you a company that has implemented process-driven, new client acquisition strategies to drive predictable profitable organic growth?

The Current Market Environment: The Good, the Bad and the Ugly

In today’s current reality, the insurance industry has weathered “what if” scenarios over-and-over again, showing the world how resilient it is. Yes, this resilience is legitimate. In fact, the volatility of insurance brokerage relative to all other industries in times of turmoil is comparatively quite low. However, some of that stability has been influenced by external factors making insurance brokers the beneficiaries of a 15-year positive run-in valuations. The industry is resilient, but the truth is, there has been a strong continuous gust of wind to its back.

The good: The U.S. recently experienced the longest period of economic expansion in history – which started at the end of the Great Recession (June 2009) and technically ended at the start of the COVID-19 pandemic (March 2020), albeit briefly. Then, after the short-lived GDP rollercoaster during COVID-19, the expansion is back and has been positive since Q3 2022.

The bad: Following the COVID-19 pandemic in 2020, the U.S. inflation rate reached a high of 9.1% in June of 2022. This rise in the cost of goods came as the impact of supply chain delays (due to the pandemic) finally began to take more of an effect on consumer prices. Fiscal instability followed in the wake of the pandemic, consumer insecurity, and the Russia-Ukraine war. But the “bad” produced unprecedented claims inflation and exposure base growth. While it has been painful for insureds, brokers have been rewarded handsomely.

The ugly: In response to rising inflation, the Federal Reserve (Fed) began to increase the Federal Funds Rate in March 2022, making a total of 11 interest rate increases through July 2023, before holding. The repercussions of rising interest rates, the subsequent increase in the cost of capital and tighter lending practices following the banking crisis, had an impact on M&A in the insurance industry. Deal activity dropped in 2022 following the record-breaking year of 2021. But it didn’t drop much, and it never really got that ugly. Strong organic growth relative to the increased cost of capital made the math work and valuations held.

But the ugly could have been uglier. Much uglier. The insurance business tends to be counter cyclical and as a result, some of the risk was buffered. Higher claims inflation put pressure on combined ratios and earnings which translated to more rate increases that will continue until the industry is in crossover. But very few would have predicted the strength of the economy today. While this industry truly is resilient, and appears to weather the down cycles and adverse economic conditions with hardening premium rates, which ultimately benefits the insurance broker – can that be counted on in every case? If history flawlessly predicts the future – then yes. But life isn’t that simple. Hope for the best, but plan for the worst.

How the Hard Market Helps Brokers

It’s estimated that the insurance brokerage industry is 6-8 years into a hard market. MarshBerry defines a hard market as a period where product premium rates increase by over 5% for two or more years. Experientially, a hard market period is characterized by increased premium rates, restricted coverage, and lower capacity – caused by an increase in demand and decrease in supply of policies.

But insurance brokers have historically had success passing along those inflationary costs, turning a challenging environment into a profitable one. Because with rising premiums, comes higher commissions and potential year-over-year increase in overall revenue for the brokerage firm. In fact, over the last ten years, Property & Casualty (P&C) net premiums written have increased at greater rates compared to inflation.

The Amount of Institutional Debt Raised in this Industry is Staggering

Since the record 10+ years of positive economic conditions, and despite the 3+ years of challenging inflation and interest rates, several weather-related catastrophic events, and increased loss ratios for carriers – the insurance brokerage industry continues to thrive. So much so, that even with the elevated cost of capital, the investment community is supporting this industry more than ever before.

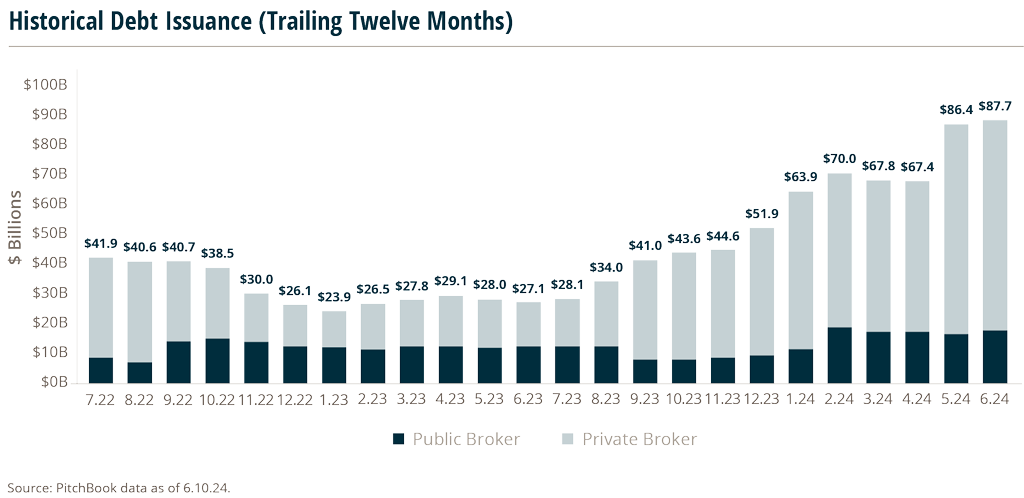

In fact, over the past 12 months (through June 2024) there has been over $87 billion in institutional debt raised in this industry, representing the highest amount ever raised in the insurance industry in a 12-month period.

Because of the perennial need for insurance products, its recurring revenue model, and resiliency during tough market conditions and global adversity, the insurance industry has become a very attractive investment class. And the top investors during this hard market run have been PE firms.

Private Equity’s Dominance in the Insurance Industry

Even before this hard market, PE recognized the value of this investment class, seeing the resiliency of their insurance investments during the Great Recession.

Following the 2008 financial crisis, the Fed went through a period of multiple quantitative easing programs to help stimulate the U.S. economy, essentially flooding the market with currency to push interest rates down. This propelled the PE world to take on substantial leverage at a low cost of capital, for which they looked to capitalize on with attractive investments.

The PE recapitalization deals of USI Insurance Services (in 2012) and Hub International Limited (in 2013), reflected the substantial rise in valuations of insurance brokerages and the strategic role that PE plays in this industry. Those deals allowed USI and Hub to pursue growth opportunities that would solidify their positions as leading insurance brokers today.

After that, the M&A flood gates opened for the insurance industry, going on a run that peaked in 2021, and shows no signs of slowing down. Since 2007, the number of private capital funded brokers has swelled from 7 to 45 in 2024.

Much of this recent activity is also due to the credit markets’ confidence in this industry, completely supporting these highly leveraged brokers in their pursuits. Even at higher interest rates, spreads have also come down highlighting that the investment community in this credit class is being more aggressive. Relevant to the amount of debt a buyer can borrow, leverage ratios are creeping back up to above 7x – like the good old days of 2021. Debt capacity is going up, while debt pricing will hopefully be going down at some point in late 2024.

Organic Growth in a Hard Rate Environment

In theory, this increase in the cost of capital (due to Fed interest rate hikes to combat inflation) should have significantly slowed down the rate of investments and M&A – which it did somewhat after the record year of 2021, but not to a point where valuations suffered, or demand waned.

That’s mostly thanks to the record levels of organic growth experienced across this industry, as the hard market and GDP growth generated significant revenue in the form of rising premiums and increased exposure base. In fact, in 2023 the insurance brokerage industry experienced the highest average organic growth rates on record at 9.7%, with peak performing firms (Best 25%) seeing 18.3%.

However, if you discount the nearly seven percentage points that the hard rate environment and increased exposure base contributed to the average firms’ organic growth – the resulting “real organic growth” rate for the average insurance agency/broker was closer to 2.7%.

Essentially, those external market factors may have provided a lifeline to many firms that were over leveraged.

The reality is — too many firms are naïvely sitting complacent, enjoying the utopian universe of a hard rate environment and strong economy that deserves meaningful credit for the industry’s organic growth success. In the immortal words of Warren Buffett, “You don’t find out who’s been swimming naked until the tide goes out.” In this industry, only when (not if) this hard market tide retreats will we see which firms are truly prepared to compete and grow significantly enough to warrant the interest of deep-pocket investors in this industry.

Passing the QoG Test

Even as the insurance brokerage industry continues to evolve to stay competitive and profitable, so have buyer methodologies evolved for measuring the valve of firms they are interested in pursuing. An emerging trend in measuring the potential value of a brokerage targeted for acquisition is the “QoG.”

In this current market, average firms (or better) are growing at about 10% or more. So what? Today, buyers are digging into that organic growth number and using QoG metrics to understand where that growth is coming from and whether it will be sustainable in less optimal market conditions.

QoG looks at multiple metrics, including a firm’s sales velocity. Buyers want to know how much of the organic growth is coming from net new sales and why – compared to other external influences such as premium rate increases, exposure base changes or other economic factors. There is also a deep review into a firm’s core fundamentals such as industry verticals, value proposition, cross selling, up selling, team selling, training and onboarding, mentorship structure, referral request process, etc.

Additionally, buyers are looking to see if you are diversified in your offerings. Are you offering more than just commercial P&C? Do you offer personal lines, wealth and retirement, employee benefits, managing general agent (MGA) capabilities, Lloyd’s access? Or are you too dependent on too few lines?

Today, buyers are also looking at the data and technology capabilities of target firms. They want to understand the platforms being used to manage people, activity, pipeline, projections and any points of differentiation that make them stand out against other targets.

These differentiation points are showing up in the valuation spread between an average firm’s base purchase price and the average top performing platform firms’ base purchase price. Based on MarshBerry’s proprietary database, the difference between average and platform firms’ base purchase price is nearly 3x EBITDA (earnings before interest, taxes, depreciation and amortization).

Eyes Wide Open

The concept that some brokers are blindly operating in a utopian universe isn’t farfetched. Aside from the small break during COVID-19, most brokers have experienced a solid 15-year run (perhaps their entire career) in ideal market conditions that may be making many feel invincible. Or worse – complacent.

These proposed “what if” scenarios are legitimate possible economic situations that could negatively impact the growth and value of many firms. The past few years have been a mental rollercoaster for the U.S. economy, hinging on the battle between inflation, interest rates and the labor market. Even now (as of August 2024), with slowing inflation, slowing jobs market and pending interest rate cuts – the economy teeters between expansion and recession.

For many in the insurance industry, this might not change their “business as usual” approach. After all, they’ve seen worse, and have survived. But this is a dangerous way to look at market conditions, and eventually some firms will find out the hard way.

The key to success in this industry is understanding the insurance cycle and what type of conditions or events might impact rates to swing from hard market to soft market and back again. From expansion to recession and back again. You also need to understand that you have no control over any of that.

What you do have control over, is your own ability to create a business model for sustainable growth. With the right people and the right processes in place, firms can survive, even thrive, in any market condition – utopian or less favorable. So, what’s the quality of your growth?